KARACHI: The stock market came under pressure on Friday amid speculations about the interest rate direction and declining energy prices.

Arif Habib Corporation Ltd analyst Ahsan Mehanti said the pressure on listed companies was due to the next announcement of the key interest rate scheduled for Oct 30 as well as falling global crude oil prices.

Factors like a weakening rupee and reduced foreign exchange reserves, which dropped to $7.5 billion as per the latest announcement, contributed to the pessimism on the bourse.

The highest economic decision-making body’s decision for a massive hike in the industrial gas tariff amid the Rs4.5 trillion circular debt in the energy sector also played the role of a catalyst in the bearish close.

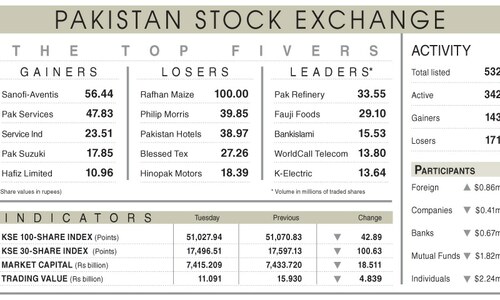

As a result, the KSE-100 index closed at 50,943.84 points after losing 241.44 points or 0.47 per cent from the preceding session.

The overall trading volume decreased 3.6pc to 350.8 million shares. The traded value also dipped 2.9pc to Rs10.6bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (45.2m shares), WorldCall Telecom Ltd (21.8m shares), the Bank of Punjab Ltd (17m shares), Dewan Cement Ltd (15.4m shares) and Al-Shaheer Corporation Ltd (10.9m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs900), Sapphire Fibres Ltd (Rs66.58), Bhanero Textile Mills Ltd (Rs64.99), Pakistan Hotels Developers Ltd (Rs33.37) and Siemens Pakistan Engineering Ltd (Rs22.32).

Companies registering the biggest declines in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs250.88), Nestle Pakistan Ltd (Rs174.99), Exide Pakistan Ltd (Rs24.67), Service Industries Ltd (Rs19) and Atlas Battery Ltd (Rs18.94).

Foreign investors were net buyers as they purchased shares worth $0.39m.

Published in Dawn, October 28th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.