KARACHI: Trading on the stock market commenced on a positive note in the outgoing week driven by positive developments in the energy sector.

Arif Habib Ltd said the approval of the much-anticipated gas tariff hike by the Economic Coordination Committee was a significant step towards meeting one of the prerequisites for the review by the International Monetary Fund (IMF) scheduled to begin on Nov 2.

Another positive development was that the current account deficit for September was recorded at $8 million, down 95pc from a month ago.

The positive momentum was further bolstered by the corporate results season, which helped sustain the upward trajectory.

However, the month-long appreciation of the Pakistani rupee ended, resulting in the dollar closing at 280.57 after depreciating by 0.64pc on a weekly basis.

Moreover, foreign exchange reserves decreased by $220m to reach $7.5bn.

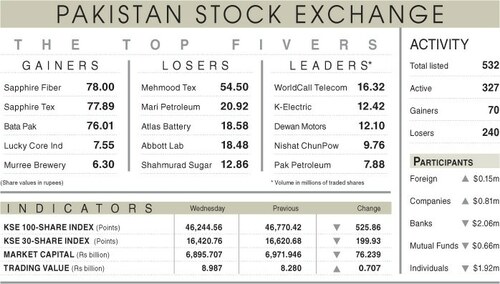

As a result, the KSE-100 index closed at 50,944 points after increasing by 212 points or 0.42pc week-on-week. Sector-wise, positive contributions came from commercial banking (369 points), cement (71 points), power generation and distribution (41 points), leather and tanneries (30 points) and automobile assembling (24 points).

Meanwhile, sectors that contributed negatively were fertiliser (164 points) and technology and communication (102 points).

Scrip-wise, positive contributors were Bank AL Habib Ltd (304 points), Meezan Bank Ltd (62 points), the Hub Power Company Ltd (50 points), Pakistan State Oil Company Ltd (43 points) and Oil and Gas Development Company Ltd (40 points).

“We expect the market to retain the positive momentum in the coming week. A status quo in the monetary policy is poised to bolster investor confidence,” said the brokerage.

Published in Dawn, October 29th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.