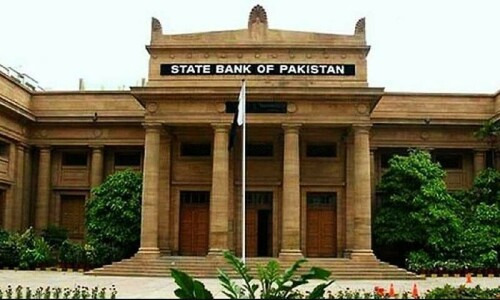

The State Bank of Pakistan (SBP) has decided to maintain the status quo and keep the key policy rate unchanged at 22 per cent, according to a press release issued on Monday.

The decision to keep the interest rate unchanged — at par with several analysts’ expectations — by the central bank’s Monetary Policy Committee (MPC) came after government data showed September consumer inflation hit another high of 31.4 per cent.

The decision comes ahead of a visit by a delegation of the International Monetary Fund (IMF) on Thursday that will review progress on targets set in a $3 billion programme approved in July this year to bail out the struggling economy.

The statement issued after the MPC meeting said that the committee noted that headline inflation rose in September 2023 as expected.

“However, it is projected to decline in October and then maintain a downward trajectory, especially in the second half of the fiscal year,” it said.

“While the recent volatility in global oil prices as well as the increase in gas tariffs from November 2023 pose some risks to the FY24 outlook for inflation and the current account, the committee also noted some offsetting factors. These include the targeted fiscal consolidation in Q1; improvement in market availability of key commodities; and the alignment of interbank and open market exchange rates,” it said.

The committee also noted some “key developments” since its September meeting. These included initial estimates for Kharif crops being encouraging, adding that it would have “positive effects” on other key sectors.

It further said that the current account deficit narrowed considerably in August and September, which helped to “stabilise the SBP’s foreign exchange reserves position amidst tepid external financing in these two months”

At the same time, fiscal consolidation also remained on track, with both fiscal and primary balances improving during the first quarter of FY24. In addition, the committee said that while “core inflation remains sticky, inflation expectations of both consumers and businesses improved in the latest pulse surveys”.

“However, global oil prices remain quite volatile and the conflict in the Middle East makes its outlook even more uncertain,” the committee said.

“In the light of these developments, the MPC emphasised on continuing with the tight monetary policy stance. The MPC reiterated its earlier view that the real policy rate is significantly positive on 12 month forward-looking basis and is appropriate to bring inflation down to the medium-term target of five to seven per cent by end-FY25.

“However, the MPC noted that this outlook is based on continued fiscal consolidation and timely realisation of planned external inflows,” it said.

The handout said that recent data on economic activity strengthened the MPC’s earlier expectation of moderate economic outlook growth for this year.

“In particular the latest production estimates of major Kharif crops show considerable increase compared to last year,” it said. It also noted moderate recovery in other key activity indicators such as cement, price of petroleum products and auto sales was gaining traction.

It said that large-scale manufacturing (LSM) output had indicated a “gradual improvement” in the first two months of this year, with major contributions coming from domestic-oriented sectors.

The MPC further stated that it was optimistic that inflation would decrease in the coming months, “which will absorb major negative developments”. The recent volatility in global oil prices, as well as the impact of a substantial increase in gas tariffs, maintains inflationary pressure, it added.

Additional input from Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.