KARACHI: Trading on the shares market commenced on the week’s first working day on a strong note as the benchmark of major stocks remained in the green zone throughout trading hours.

Topline Securities Ltd said the KSE-100 index settled on the higher side ahead of the State Bank of Pakistan’s monetary policy announcement, which was scheduled in the post-trading hours on Monday.

Power, fertiliser, cement and banking sectors contributed positively to the index’s rise, it added.

According to Arif Habib Ltd, the stock market has witnessed a strong weekly start with the index trading towards the upper end of its current range of 50,500-51,500 points.

“Trade above 51,500 points will target 53,000 points (in the) near term while a rejection sets up a dip towards 50,000-50,500 points,” it added.

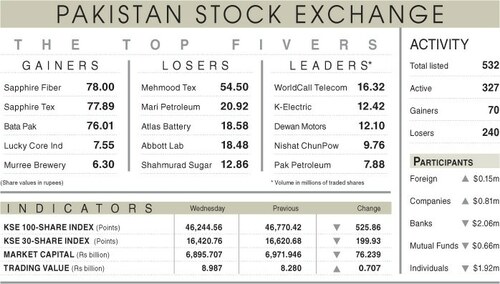

As a result, the KSE-100 index closed at 51,482.93 points after gaining 539 points or 1.06 per cent from the preceding session.

The overall trading volume decreased 18.3pc to 286.6 million shares. The traded value increased 7.9pc to Rs11.4bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan Refinery Ltd (32.4m shares), the Bank of Punjab Ltd (20.3m shares), WorldCall Telecom Ltd (15.2m shares), Maple Leaf Cement Factory Ltd (11.3m shares) and Air Link Communication Ltd (10.6m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs325), Rafhan Maize Products Company Ltd (Rs199.88), Nestle Pakistan Ltd (Rs138), Reliance Cotton Spinning Mills Ltd (Rs37.50) and Pakistan Hotels Developers Ltd (Rs35.88).

Companies registering the biggest declines in their share prices in absolute terms were Sapphire Fibres Ltd (Rs86.33), Bhanero Textile Mills Ltd (Rs59.99), Pakistan Services Ltd (Rs25), Pakistan Engineering Company Ltd (Rs25) and Archroma Pakistan Ltd (Rs18.64).

Foreign investors were net sellers as they offloaded shares worth $0.87m.

Published in Dawn, October 31st, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.