KARACHI: Pakistan is the third biggest recipient of Chinese development finance worldwide with a portfolio of $70.3 billion, according to a report released on Monday by AidData, a US-based international development research lab.

Only two per cent of China’s portfolio in Pakistan between 2000 and 2021 consisted of grants while the rest was in the form of loans, says the AidData report that claims to have drawn its conclusions using data from more than 5,300 sources.

The average interest rate on loans was 3.72pc with an average maturity period of 9.84 years and a grace period of 3.74 years, according to the American research house.

The top sector that received development finance in 2000-2021 was energy with a share of 40pc or $28.4bn. General budget support (30pc share or $21.3bn) and transport and storage (14pc share or $9.7bn) were the next two major recipients of Chinese financing, data shows.

The energy portfolio of $28.4bn was the biggest in the world, with Angola ($24.7bn) and Vietnam ($21.7bn) following as the second and third biggest recipients of Chinese development finance over the same period. Pakistan’s energy portfolio represented 10.2pc of China’s entire global energy portfolio across dozens of countries, the AidData report claims.

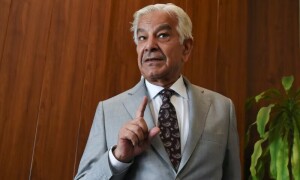

An administration-wise breakdown of Chinese development finance between 2000 and 2021 showed that the PML-N government (2013-17) managed to attract the highest flows ($36.2bn) in the 21-year period. The PTI government attracted $19.6bn, the PPP government $10.4bn and the Musharraf government $4.1bn.

The energy sector was the biggest recipient of development finance (52.8pc) under the PML-N government while “general budget support” remained the top destination (61.3pc) of flows under the PTI government, data showed.

Since 2012, China has been Pakistan’s single-largest foreign development financing provider, outspending the United States by 1.6 times in 2013, 7.7 times in 2016 and 22.4 times in 2021.

Data showed 82pc of the projects committed until 2021 were “completed” with another 13pc remaining “under implementation”.

Out of 47 projects worth more than $500 million, the majority were in general budget support (21), followed by energy (15) and banking and financial services (six). As for the 17 projects of more than $1bn, six were in general budget support and five were in energy.

Data showed the annual rate of commitments rose from $509m during the Musharraf era to $2.1bn in the PPP government. It hit $7.2bn a year in the Sharif/Abbasi years. In the years of the PTI government, average annual commitments amounted to $4.9bn but those were driven by general budget support lending, data showed.

With a total of 161 loans worth $68.9bn, Pakistan constituted China’s third largest country-level loan portfolio anywhere in the world, after Russia and Venezuela, the report claims.

At $28.13bn, rescue lending to Pakistan originating in China was the highest in the world, followed by Argentina, Ecuador and Venezuela. This points to the “particularly close all-weather friendship between the two countries,” it said.

Pakistan’s public debt exposure to China is $67.2bn, which is 19.6pc of GDP. “Since 2017, larger proportions of Chinese development finance are for rescue loans, rather than developmental projects, which was the hallmark of CPEC in its heyday (2014-2017) when fresh commitments were forthcoming in large values,” said the report.

The post-2017 years also saw roll-overs become more common and either matched or exceeded new loan commitments since 2019.

Out of 127 infrastructure projects worth $38.8bn, only three projects worth $452m have been suspended or cancelled thus far, data showed.

More than half (52pc) of the infrastructure project portfolio has faced some Environmental, Social and Governance (ESG) risks, according to AidData’s estimates. The energy sector has faced the greatest ESG risks with 51pc of the portfolio facing one or more of these challenges, it claims.

Only a quarter of these projects have strong ESG safeguards in place, as per AidData’s classification. As opposed to only 16pc and 19pc for environmental and governance risks, respectively, as many as 46pc of these projects faced social risks such as labour violations or community protests, the report claims.

Published in Dawn, November 7th, 2023