KARACHI: Profit-taking by sceptical investors put a stop to the northbound journey of the stock market’s benchmark on Friday after six consecutive sessions of index gains.

Topline Securities Ltd said the KSE-100 index opened on a positive note and gained momentum to hit an intraday high of 354 points before hitting roadblocks.

Arif Habib Ltd analyst Ahsan Mehanti attributed the loss in index points to news reports about a further hike in gas and power tariffs under the ongoing loan programme with the International Monetary Fund as well as a slump in global crude oil prices.

Additionally, dismal data on cement sales, which fell 5.8 per cent year-on-year in October, and the finance minister’s concerns over $6.5 billion external financing shortfall risks played the role of a catalyst in the bearish close, he added.

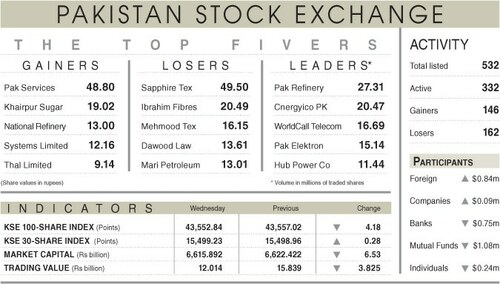

As a result, the KSE-100 index closed at 57,063.16 points after losing 333.87 points or 0.58 per cent from the preceding session.

The overall trading volume decreased 14.6pc to 901.5m shares. The traded value decreased 18.8pc to Rs23.4bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (176.7m shares), K-Electric Ltd (76.3m shares), Fauji Foods Ltd (46.4m shares), Hum Network Ltd (37.8m shares) and Cnergyico PK Ltd (31.7m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs1,000), Rafhan Maize Products Company Ltd (Rs671.25), Pakistan Engineering Company Ltd (Rs35.47), Pakistan Hotels Developers Ltd (Rs27.77) and Indus Motor Company Ltd (Rs25.80).

Companies registering notable decreases in their share prices in absolute terms were Nestle Pakistan Ltd (Rs200), Sapphire Textile Mills Ltd (Rs81.22), Blessed Textiles Ltd (Rs26.99), Lucky Cement Ltd (Rs18.82) and Pak Suzuki Motor Company Ltd (Rs11.63).

Foreign investors were net buyers as they purchased shares worth $1.92m.

Published in Dawn, November 18th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.