KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) continued its upward journey in the outgoing week.

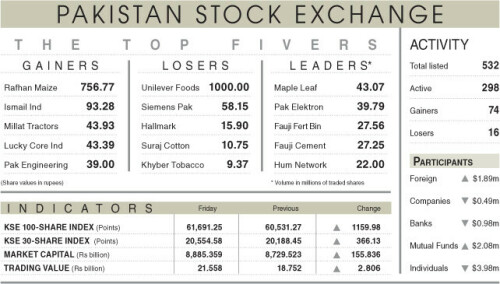

The KSE-100 index maintained its unrelenting bullish momentum to finally settle at an all-time high of 61,691 points after gaining 4.4 per cent on a week-on-week basis, according to AKD Securities Ltd.

Although the market participation witnessed a dip of 6.7pc from the preceding week, investors remained engaged amid the historic rally with the average traded volume of 612.5 million shares.

The impetus of post-International Monetary Fund (IMF) review success sustained with a notable increase in foreign inflows into the market. Net foreign buying hit its six-year high of $35m in November.

Furthermore, investment agreements with Kuwait and the United Arab Emirates, $3 billion deposit extension by Saudi Arabia, $2bn expected inflow from the World Bank in 2023-24, and above-target tax collection to the tune of Rs3.48bn in July-November bolstered market sentiments.

Furthermore, the trade deficit for November witnessed a 13pc month-on-month decline to settle at $1.9bn versus $2.2bn in the preceding month.

Meanwhile, the week concluded with an elevated inflation reading of 29.2pc year-on-year, exacerbated by the recent gas price hike.

On the currency front, the rupee appreciated against the dollar to close at 284.97 after gaining 0.1pc from a week ago.

Additionally, foreign exchange reserves of the State Bank of Pakistan clocked in at $77m higher at $7.3bn.

Sector-wise, buying was witnessed across the board as every sector, except REITs, closed in the green. Emerging as top performers during the week were close-end mutual funds, woollen, tobacco and automobile assemblers, up 66.5pc, 54.8pc, 43.4pc and 39.9pc, respectively.

Flow-wise, banks remained major buyers, netting $14.9m, while major selling was by “other organisations” that amounted to $1.49m.

Company-wise, top performers during the outgoing week were DG Khan Cement Ltd (23.1pc), Atlas Honda Ltd (22.3pc), Millat Tractors Ltd (20.1pc), Pakistan Services Ltd (18.5pc) and Friesland Campina Engro Pakistan Ltd (14.7pc).

“Going forward, we maintain an optimistic outlook on the market. We believe the present rally will continue, albeit with episodes of profit-taking,” it said, adding that its stance stems from the positive conclusion to the IMF’s review amidst improving macroeconomic indicators and fading uncertainty on the political front.

Published in Dawn, December 3rd, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.