The benchmark index of the Pakistan Stock Exchange (PSX) maintained its upward momentum on Friday and crossed the 66,000 milestone, buoyed by declining oil prices and foreign buying.

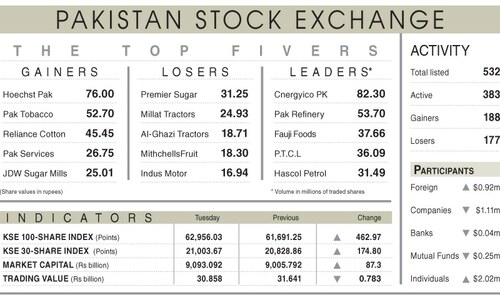

According to the PSX website, the KSE-100 index closed at 66,223.63, up by 1,505.56 points, or 2.33 per cent, from the previous close of 64,718.07.

A day earlier, the shares market crossed the 64,000 level in what was the sixth consecutive day-on-day gain even though the benchmark of representative shares exhibited some volatility.

Tahir Abbas, head of research at Arif Habib Limited, told Dawn.com that there was a “flush of domestic liquidity pouring into the market”.

He said Arif Habib analysts estimate that “for every 1pc conversion from fixed income to equities in the asset under management (AUMs) of Mutual funds and Insurance companies, Rs36bn would be deployed in the market”.

Mohammed Sohail, chief executive of Karachi-based brokerage firm Topline Securities, attributed today’s run to declining oil prices and continuous foreign buying.

He noted that investors had a new-found confidence in the direction of economic policies and were taking advantage of low valuations as the market, even with its gains, was trading at a cheap price-to-earning ratio.

Meanwhile, Raza Jafri, head of equity at Intermarket Securities, told Dawn.com that the market was taking bad news — high Consumer Price Index print and delay in the International Monetary Fund board meeting — in its stride.

“Investors are rightly focusing on the cheap valuations, a reasonably settled top-down environment, and lots of room for institutional money to rotate into equities,” he said.

Jafri further warned that the sharp run up was also leading to enhanced volatility, opening up the possibility of large intraday swings.

Govt committed to sustain market growth: PM

In an address at a ceremony at the PSX earlier in day, Prime Minister Anwaarul Haq Kakar vowed to sustain and nurture the growth in the capital market.

He emphasised the importance of the capital market’s resilience, as it “acts as a stabilising force absorbing shocks and steering our economy towards stability”.

PM Kakar also called for efforts to build a capital market that not only mirrored economic strength but also embodied values of fairness and integrity.

The premier attributed the recent performance of the benchmark index to improved economic outlook and the participation of foreign investors.

He added that investors had regained their confidence due to efforts by the government in its successful signing of the IMF standby agreement and improvements in the fiscal and external accounts.

Dear visitor, the comments section is undergoing an overhaul and will return soon.