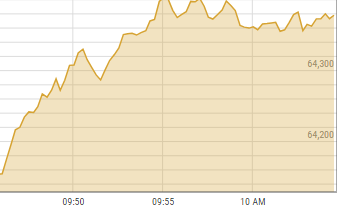

KARACHI: The benchmark of major shares listed on the Pakistan Stock Exchange (PSX) scaled new heights on Friday by breaching the yet another psychological barrier of 66,000 points.

Topline Securities Ltd reported the ongoing bull run on the national bourse has cumulatively added 24,600 points or 59 per cent since the beginning of 2023-24 over five months ago. The index has gained 11,000 points or 20pc in just four weeks, which translates to a gain of 1pc every day, according to the brokerage CEO.

The rally in share prices on Friday was driven by the anticipation surrounding the upcoming board meeting of the International Monetary Fund scheduled for January 11. The meeting will review and potentially approve the disbursement of a $700 million tranche under the current Stand-by Arrangement.

The banking sector led the gains as its constituents closed on average about 4pc higher on a day-on-day basis.

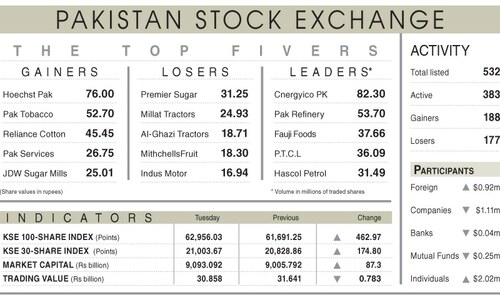

As a result, the KSE-100 index closed at 66,223.63 points after gaining 1,505.55 points or 2.33 per cent from the preceding session.

The overall trading volume increased 0.9pc to 1.3 billion shares. The traded value decreased 10.2pc to Rs33.3bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (342.5m shares), WorldCall Telecom Ltd (98.5m shares), Pakistan Telecommunication Ltd (58.7m shares), Kohinoor Spinning Mills Ltd (56.6m shares) and Fauji Foods Ltd (47.9m shares).

Companies registering the biggest increases in their share prices in absolute terms were Nestle Pakistan Ltd (Rs200.02), Sapphire Fibres Ltd (Rs97.31), Pakistan Services Ltd (Rs76.88), Pakistan Tobacco Company Ltd (Rs60) and Mari Petroleum Company Ltd (Rs54.75).

Companies registering the biggest decreases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs599.75), Ismail Industries Ltd (Rs95), Hoechst Pakistan Ltd (Rs77), Bata Pakistan Ltd (Rs27.70) and Pakistan Hotels Developers Ltd (Rs11.56).

Foreign investors were net buyers as they purchased shares worth $1.53m.

Published in Dawn, December 9th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.