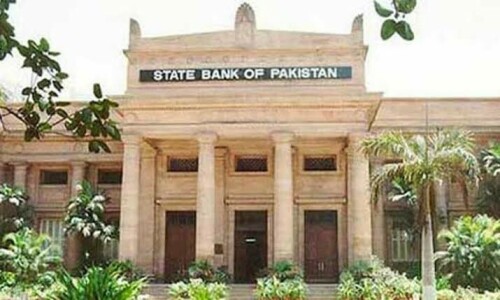

KARACHI: The State Bank kept the interest rate unchanged at a record 22 per cent on Tuesday for the fourth consecutive meeting, hoping to see a significant decline in inflation in the second half of the fiscal year.

Most independent economists and analysts expected the central bank to hold the rate steady due to a surge in the November inflation.

The bank’s monetary policy committee (MPC) said that an increase in gas prices last month could affect the inflation outlook.

“The decision does take into account the impact of the recent hike in gas prices … the Committee viewed that this may have implications for the inflation outlook, albeit in the presence of some offsetting developments,” it said in a statement.

MPC takes decision given surge in inflation due to hike in gas prices

In an off-cycle meeting on June 26, the SBP raised the policy rate to 22pc as a last-gasp attempt to secure a $3 billion bailout from the International Monetary Fund (IMF) as part of a reforms programme aimed at bringing stability to the economy.

The country’s economy has been beset by high price pressures, with monthly consumer price index-based inflation remaining above 20pc since June 2022, and hitting a record high of 38pc in May this year.

The bank and the IMF both say they expect inflation to ease in the current financial year, but inflation remained at 29.2pc in November after the government increased energy prices to meet reform targets.

“The MPC noted that the higher-than-expected increase in gas prices contributed 3.2 percentage points to the 29.2pc y/y (year-on-year) inflation in November 2023,” the bank said.

“Further, core inflation remained sticky at 21.5pc during the month, only slightly lower from its peak of 22.7pc in May 2023. Inflation expectations of both consumers and businesses, though improving in recent months, remain at an elevated level.

“Nevertheless, barring a further sizable increase in administered prices, the MPC continues to expect that headline inflation will decline significantly in the second half of FY24 due to contained aggregate demand, easing supply constraints, moderation in international commodity prices and favourable base effect.”

Several economists have criticised the central bank for keeping the interest rate pegged with core inflation, which they say is against the norms prevailing in other economies.

In the statement, the SBP said that its committee assessed that the real interest rate continues to be positive on a 12-month forward-looking basis and inflation is expected to remain on a downward path.

It said the current monetary policy stance is appropriate to achieve the inflation target of 5pc-7pc by the end of the 2024-25 fiscal year.

The SBP said that the recovery in real GDP during the current fiscal year (FY24) is expected to remain moderate. According to the first estimates, real GDP grew by 2.1pc year-on-year in the first quarter (July-September) of this fiscal year compared to 1pc a year ago.

Published in Dawn, December 13th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.