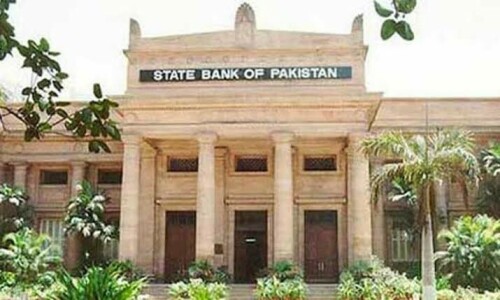

WITH inflation predicted to start easing, the decision taken at the State Bank’s monetary policy committee meeting to hold the key interest rate steady — for the fourth time since June — shows that the SBP is not willing to leave the goal of price stability to chance this time.

Its position might appear hawkish and a case of once bitten, twice shy in view of a more stable currency, positive 12-month forward real interest rates, reduced global oil prices, a successful IMF programme review and the forecast that inflation will taper off in the coming months. Meanwhile, the depressed growth also makes a case for a rate cut.

However, others argue that both headline and core inflation readings remain high, reserves are falling as foreign official and private inflows dry up, and exchange rate stability is still fragile.

A shift to monetary easing at this time, therefore, might potentially result in a spike in imports, resulting from pent-up demand and lead reserves — which are barely enough to cover two months’ imports — to drain quickly. This could cause the exchange rate to deteriorate and the current account deficit to widen, thwarting efforts to tame prices.

Besides, real interest rates remain negative given the monthly inflation recordings, while Pakistan’s trading partners have positive real interest rates. Thus, a rate cut at this moment is not justified.

The SBP has, in the recent past, got its inflation forecast wrong on quite a few occasions. That it is for once trying to get ahead of the curve to achieve price stability in the medium term, targeting 5-7pc CPI inflation by the end of June 2025, should be appreciated.

There is no doubt that the SBP is taking a cautious approach as the decision to leave the interest rate at the all-time high of 22pc takes into account the impact of the recent gas price hike, which, the MPC says, “may have implications for the inflation outlook, albeit in the presence of some offsetting developments, particularly the recent decrease in international oil prices and improved availability of agriculture produce”.

With headline inflation surging to 29.2pc in November, compared to 26.9pc in the previous month, and core inflation at 21.5pc, only slightly lower from its May peak of 22.7pc, the MPC admits that the actual impact of the administered gas prices is “relatively higher than [its] earlier expectation”.

How can SBP return to monetary easing and ensure price stability when unknown risks to inflation threaten to wipe out the few gains resulting from a tighter stance? Rates must come down — but gradually, when inflation starts easing and foreign exchange reserves begin to rise. Rash decisions could land us in greater trouble. What we need the most at the moment is a little bit of patience.

Published in Dawn, December 14th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.