Bears continued their dominance on the trading floor of the Pakistan Stock Exchange (PSX) on Wednesday, with analysts attributing the sell-off to pre-election uncertainty and high leverage costs.

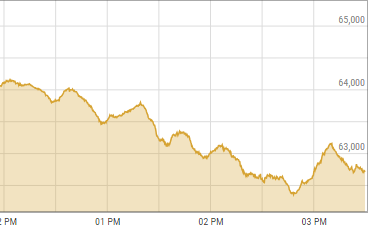

According to the PSX website, the KSE-100 index plunged by 1484.58 points at 1:40pm to sink to 61,345, down 2.21 per cent from the previous close of 62,833.03.

The index managed to recover most of its losses later in the day and closed at 62,448.01 points, down 385 points or 0.61pc from Tuesday’s close.

A day earlier, shares witnessed the second-biggest overnight fall in the 32-year history of the benchmark index. As many as 94 shares of the KSE-100 index took a beating while the remaining six shares either advanced or closed flat.

Analysts had attributed the sharp decline to profit-taking by investors who believed the market was heating up after a rapid gain of 25,000 points to the index in the last few months.

Ahsan Mehanti, chief executive of Arif Habib Commodities, told Dawn.com that the main bear market drivers were pre-election uncertainty and concerns over falling foreign inflows.

He highlighted that investor concerns for “high leverage and high leverage cost played a catalyst role” in the market performance.

Shahbaz Ashraf, chief investment officer at Karachi-based investment company FRIM Ventures, attributed the downward spiral to a number of factors.

He said the leveraged position was “being squared up as leverage has doubled to Rs40 billion from Rs20bn in the last few months”. The banking sector was also booking profits as it aimed to realise gains.

However, Ashraf noted that the fundamentals behind the trade remained the same.

Mohammed Sohail, chief executive of Topline Securities, said the “over-leveraged position in the market” was triggering the bearish momentum. “With the year ending, the big players on the stock market are on the sideline,” he said.

Raza Jafri, head of equities at Intermarket Securities, highlighted that this week’s “correction continues on a combination of unwinding leveraged positions and returning nervousness as elections approach”.

Dear visitor, the comments section is undergoing an overhaul and will return soon.