The country’s elite class are gearing up to purchase hybrid electric vehicles (HEV) and electric vehicles (EV) despite the uncertain political and economic environment amid the highly depressed sales scenario of fossil fuel vehicles.

Will the buyers of petrol and diesel-driven SUVs and pickups shift to HEVs and EVs, or will a new wealthy class rise to acquire these costly electrified vehicles?

The rich class usually seems less concerned than the masses about the rising cost of living triggered by soaring food inflation, utility bills, and petroleum prices. However, the auto data shows a 59 per cent drop in total car sales during FY23 to 96,811 units from 234,180 during FY22. The fall in jeeps and pickup sales was 36pc, from 45,087 during FY22 to 30,067 in FY23.

Total car sales during 5MFY24 shrank by 53pc to 25,746 from 55,132 in the same period last fiscal year, while jeep and pickup sales came down by 36.6pc to 7,594 from 11,972.

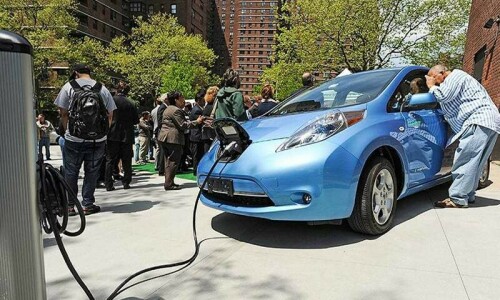

Electric vehicles allegedly have a payback period of about five years compared to traditional cars

People familiar with the market say the above data suggests that middle- and upper-income groups might have restricted their purchases due to unbearable food inflation and utility bills. Historically, the elite class has kept buying costly vehicles, thus making the local assemblers highly optimistic about brisk sales in HEV and EV vehicles after losing sales volumes in SUVs and 1,300-1,600cc cars (petrol and diesel driven).

Sazgar Haval H6 HEV, Hyundai Santa Fe HEV and Toyota Corolla Cross HEV must have created a lot of interest among the cash-rich buyers. Here, the contradictory claims of being the first company to introduce locally assembled HEV by the assemblers also rule in fully charged media campaigns.

Low volume sales of HEVs and EVs may not instantly help curtail soaring petrol and diesel import bills. The advertisement of the Toyota Corolla HEV Cross in the print media, based on calculations of 30,000 units, claims a 35pc reduction in emissions, 50pc savings on imported fuels, and a 50pc cut in consumer costs due to improved mileage.

Many buyers are brand-specific. The Toyota vehicle buyers, who have already tested used Toyota hybrid Prius and Aqua for the last many years and are also using Toyota fossil fuel cars, will purchase the brand new Toyota Cross, whose price looks quite competitive to its peers.

The General Manager of the Sales and Marketing Division at MG Motors, Asif Ahmed, believes that “EV currently will not be a primary vehicle as the buyers may not buy it as a first car.” Elite consumers having two to more cars will choose an EV as the third or fifth car as an innovator or early adopters of the latest technology, he said, adding there is a possibility that a new elite will emerge to buy EVs.

He said, “we plan to locally assemble EVs from 2025. It is expected that the automotive market will only revive through economic stability in the next two years instead of an abrupt jump post-elections in February 2024, as predicted by some experts. Much will also depend on the rupee-dollar parity due to the low level of localisation.”

The MG executive estimated cumulative sales of up to 2,500 EVs in 2024 due to buyers’ adoption of the new technology. The charging infrastructure is currently considered an inhibition to EV adoption and will see robust growth similar to telecom BTS stations once the EV trend catches up.

“The world has moved towards efficient and environment-friendly EVs, and Pakistan is ready for the change in 2024,” Mr Ahmed hoped.

Currently, in Pakistan, he said, the internal combustion engine (ICE) vehicle is available at approximately Rs8 million, while hybrid and electric vehicles carry price tags of approximately Rs10m.

Given the current petrol price and claimed fuel efficiency of ICE versus hybrid vehicles, the payback period for the additional Rs2m paid upfront is almost seven years, excluding the maintenance cost involved, Mr Ahmed said.

EVs are far superior in value and benefits, he added. An EV’s payback period versus ICE is 4.8 years, while the payback period for an EV vs HV is five months only, with an EV being 50pc operationally efficient. The maintenance cost is drastically lower due to the 12-month periodic maintenance frequency.

The EV mileage estimation from a cost point of view is more than 30lm per litre, Mr Ahmed claimed, adding that the transition to the EV lifestyle depends on consumer knowledge of its value and the expansion of the charging network.

CEO Series Pakistan, Sohail Usman, believed that mainly SUV buyers of petrol and diesel vehicles belonging to the middle and upper-income group would shift towards HEVs and EVs to save their monthly cost of Rs 70,000-80,000 on consuming petrol and diesel.

“But I do not see the future of HEV as compared to a promising future of EV,” he said, predicting a sharp drop in petrol and diesel SUV vehicles and even costly sedans in the next two years. “Our company will be the first to roll out locally assembled EV Seres vehicles in April or May 2024,” he claimed.

With not enough charging stations in the city, there is also a lack of charging facilities outside the main cities. EVs can be dubbed as city cars right now as charging is being done at home, he said.

“Sensibly, the time is ripe for every local assembler to introduce EVs. Petrol and diesel vehicles of higher engine power have no future. The market situation will change in the next two years due to the entry of EVs,” Mr Usman said.

A local auto part maker and auto expert, Mashood Ali Khan, said in the last decade, sales of the Toyota Fortuner, Hyundai Tucson, KIA Sportage, Honda HRV/BRV, MG, and Changan Oshan X7 have supported the automotive industry, especially in the aftermath of the pandemic.

“I think the buyers of above vehicles will shift to HEV and EV, which means that locally assembled SUVs or sedans carrying a price of Rs8-9m will move towards Hybrid Toyota Cross and other HEV vehicles,” he predicted.

Despite significant economic challenges like high inflation, rising interest rates, issues with opening letters of credit, political instability, frequent plant shutdowns, and a steep rise in vehicle prices in the last 1.5 years, some assemblers have dared to introduce hybrid models in the SUV segment. The current pricing of models holds attraction for the elite class, posing challenges for affordability in the broader market, said Mr Khan.

He said despite issues of low localisation in HEV vehicles, it is also encouraging to note that as per Indus Motor Company (IMC), Toyota Cross HEV is “50pc localised in terms of its value.”

He anticipates that the overall market size in the SUV segment will remain relatively stable, hovering around 20,000-25,000 units per year.

However, the key differentiator will be the changing market share among brands. Brands offering enhanced features, innovative technologies, and superior value propositions may gain a larger slice of the market, Mr Khan said.

Published in Dawn, The Business and Finance Weekly, December 25th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.