AFTER a decade-long gap, privatisation in Pakistan is making a comeback.

With seven transactions in advanced stages, this revival highlights the economic policy of the caretaker government in the last four months, focusing on reforms and fiscal discipline. However, the revival of privatisation is not without its obstacles.

The politically unpopular divestment of a few state-owned enterprises (SOEs) is only half of the issue. The previous four months have also seen efforts to reclaim privatisation earnings that have been frozen since 1993.

A new privatisation policy should favour complex transactions above selling properties or units for real estate developments. The caretaker government’s privatisation decisions will be examined to compare them to the preceding political governments’ practices.

Since 1947, the government has established and sold industries to private sector. This continued until the 1970s nationalisation of big and small businesses by former prime minister Zulfiqar Ali Bhutto. However, only a small fraction of all nationalised enterprises were privatised in the 1980s, reversing Mr Bhutto’s initiatives.

In 1988, the PPP government adopted neoliberal deregulation and privatisation measures. The PML-N successfully implemented these measures after taking office. Between 1988 and the early 2000s, the two political parties privatised 167 enterprises and organisations, raising Rs476 billion. The chemical, textile, fertiliser, cement, phosphate fertiliser, rice, and light engineering sectors were privatised, along with 98 per cent of automobile industry, 96pc of ghee mills, and 80pc of banking.

After six years, the third phase listed 68 SOEs in 2013 for privatisation. The privatisation process has only completed five capital market transactions totalling Rs173bn in the banking, oil and gas sectors. Several subsequent attempts to privatise loss-making SOEs failed due to employee dissent.

The previous governments’ terrible privatisation tactics and their results, including low employment, stagnated innovation, little investment in privatised SOEs, and a growing budget deficit make it less attractive for political government to pursue it.

Caretaker govt’s privatisation

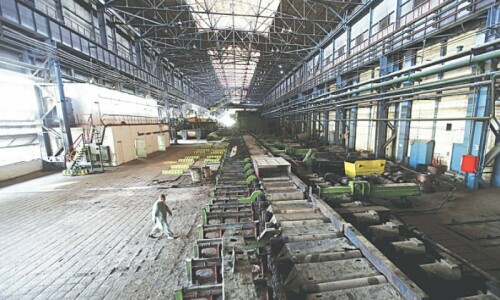

The first decision was to remove unviable firms from privatisation list. Unworked SOEs remain on the list for no apparent reason. Pakistan Steel Mill (PSM) was negotiating with one company to sell machinery for scrap and build a housing community.

The Privatisation Commission, led by Fawad Hassan Fawad, boldly returned PSM to Ministry of Industry. Many other privatised units have endured for decades for their namesake. The machinery of many privatised units in the past was sold as scrap, and the land was transformed into real estate.

The privatisation list has 28 properties. Eight of these flats are in Lahore, while the others are in dispute and cannot be privatised. A policy proposal has been submitted to the federal cabinet to exclude property transactions from privatisation. The relevant ministry handles it alone. This decision depends on government approval.

The new privatisation policy is also nearing completion, and it will hopefully address all previous faults. The last privatisation policy was introduced in 1994. However, it is unclear whether the caretaker government will approve it or leave it to the next government.

In 1993 privatisation, the government awaits payments in 123 cases. Owners bought 30-35pc of entities. Every case is in high courts, and these properties are worth billions. A Supreme Court judge will chair the caretaker government’s privatisation appellate body. Multiple jurisdictions were removed to settle multibillion rupees property payments.

The PTCL privatisation list had 900 properties, but only 33 PTCL properties were found. The mislisting of properties also delayed payments. Duplicated property will determine pricing. The duplicate listers must be held accountable and protect national interests.

The credibility of privatisation matters. International investors submitted documentation for pre-qualification, but the procedure was halted, sending a negative signal. The government must restore decision credibility.

Multi-billion dollar transactions

According to documents, financial experts have submitted two PIA privatisation reports, with a third one due next week. With these reports, all legal requirements will be met, enabling sales discussions to commence. Bidding will start at the end of the month. International airlines must be enticed to participate in the bidding process. If no state-owned carriers exist, aviation policy must be determined to protect passengers.

Financial consultants have been hired for Roosevelt Hotel joint venture development. It was once considered for $425-$426 million in sales. Bidding for the first women’s bank will begin in six weeks. The HBFCL transaction is nearing completion.

After privatising Heavy Electrical Complex, the government received the residual funds from the previous two years. The Discos privatisation process is nearing completion. However, there is a need to exercise caution when selling SOEs. The privatisation commission predicts multi-billion dollar sales revenues from seven transactions.

At the moment, no privatisation procedure is manual. The goal is to reestablish trust in the privatisation process.

Published in Dawn, January 7th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.