KARACHI: Workers’ remittances in December increased by 13.4 per cent on a year-on-year basis to $2.4 billion, compared to $2.099bn in the same month of the previous fiscal year.

However, during the first six months of FY24, remittances fell short of the amount the country received in the same period of the previous year. Moreover, remittances from almost all destinations, except European countries, declined.

The State Bank of Pakistan’s latest data issued on Wednesday shows the December remittances were higher by 5.4pc compared to November. The remittances in Nov were $2.258bn.

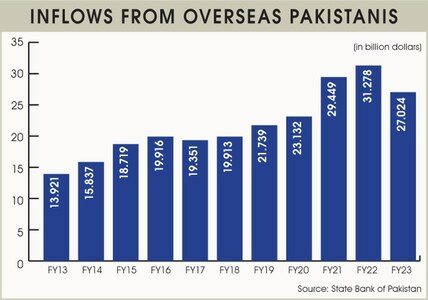

The remittances during the first half of the current fiscal year were still 6.8pc lower than the previous fiscal year. FY23 was a disappointing year for Pakistan as remittances declined by almost $4bn compared to the preceding year. The first half of the current fiscal year has yet to reach the previous year’s discouraging inflows.

Six-month inflows drop 6.8pc, declining from all destinations, except Europe

Pakistan received $13.4bn in remittances during July-Dec FY24, compared to $14.417bn in the same period last year, indicating a decline of $983 million.

While the government claims to have achieved success through a crackdown on smuggling and illegal currency business, the low inflows of remittances do not support the claim. The exchange rate appears stable with the crackdown, but the inflows did not improve. Earlier, it was pretended that the black market was attracting dollars from overseas Pakistanis, which was the main reason for the $4bn loss in remittances in FY23. However, the crackdown could not help improve remittances.

Another aspect being discussed in the banking sector is that about one million job seekers left Pakistan in FY23, but their contribution to remittances is almost zero. Exchange companies expressed satisfaction with the crackdown on illegal currency businesses, which stabilised the exchange rate and enabled the open market to sell dollars in the range of $300m to $350m per month to banks. The reason for low remittances is not known in the financial market. It is believed that overseas Pakistanis were keeping their dollars in foreign accounts due to the uncertain political and economic situation in the country.

The country received the highest inflow of $3.054bn from Saudi Arabia during the first six months of this fiscal year, but it noted a decline of 8.9pc compared to the same period last year. The inflows from the US and UK were $1.576bn and $1.988bn, with declines of 2.5pc and 0.6pc, respectively.

Another major inflow was from the UAE, with $2.328bn during the six months, but it declined by 10.9pc compared to last year. The only increase in remittances was noted in the inflows from EU countries. The inflows increased by 8.5pc to $1.695bn compared to the same period last year.

Published in Dawn, January 11th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.