Shares at the Pakistan Stock Exchange (PSX) returned to trading in the green on Thursday, gaining more than 600 points.

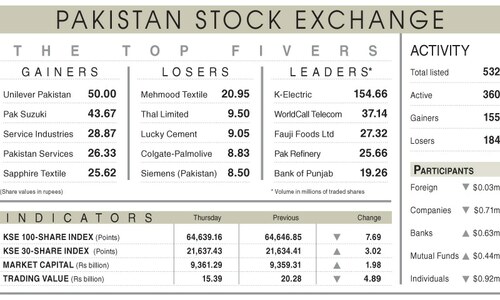

According to the PSX website, the KSE-100 index closed at 64,617.56, up by 697.72 or 1.09 pc, from the previous close of 63,919.84 points.

Raza Jafri, head of equities at Intermarket Securities, said that the the market had reacted positively to “encouraging data” of healthy remittances and lower T-bill auction yields.

This was coupled with growing positive sentiment “prompted by corporate events, such as Mari Petroleum hitting its upper circuit after announcing a decent sized gas discovery”, he added.

Additionally, Jafri also noted that the meeting of the International Monetary Fund’s (IMF) executive board on the first review of the country’s $3 billion programme was also set for later today.

Speaking to Dawn.com, Yousuf M. Farooq, director of research at Chase Securities, credited the upward trajectory to “expectations of a smooth conclusion to the IMF review”.

Moreover, he highlighted that bonds had surged — with a significant drop in one-year bond yield — which now stood at 20.85pc. He added that the anticipation of interest rate cuts, due to controlled inflation and a stable current account, had “bolstered market confidence”.

However, he cautioned that “lingering election uncertainty may contribute to on-going investor concerns”.

Mohammed Sohail, chief executive of Topline Securities, attributed today’s rally to falling yields on T-bills, saying it had “increased chances of an interest rate cut in the future”.

On Wednesday, bearish sentiments persisted in the stock market for the fifth consecutive session mainly due to pre-poll uncertainty which dragged the benchmark KSE-100 index below the 64,000-point level.

Initially, the index made an intraday high at 64,551 ( a gain of 380.37 points). However, profit-taking at the aforesaid level wiped out early gains. It witnessed an intraday low at 63,874 levels (a loss of 297 points).

Investors chose to do profit-taking in selective stocks of banks and fertiliser sectors in the backdrop of increasing political noise and the absence of any positive triggers.

Dear visitor, the comments section is undergoing an overhaul and will return soon.