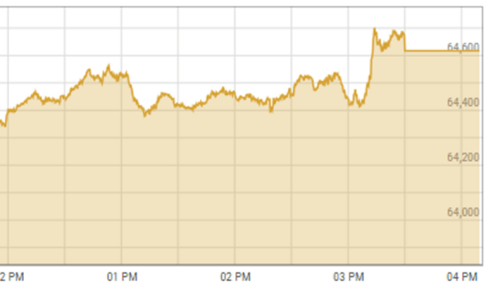

Shares at the Pakistan Stock Exchange’s (PSX) KSE-100 index on Friday failed to hold intraday gains, increasing by a mere 20 points.

According to the PSX website, the KSE-100 index had gained 565.79, or 0.88 per cent, at 10:56am to stand at 65,183.35 from the previous close of 64,617.56. Analysts had attributed the rally to the International Monetary Fund’s (IMF) Executive Board successfully concluding the first review of Pakistan’s economic reform programme.

However, the index retracted most of its gains by the end of session, up by just 20.07 points, to close at 64,637.63.

Mohammed Sohail, chief executive of Topline Securities, had credited the earlier bullish momentum to the IMF board meeting, adding that the “hint in their statement on lower inflation” bolstered positive sentiments today.

Raza Jafri, head of equities at Intermarket Securities, too had credited the initial rally to the IMF board’s approval. He added that the IMF estimated June’s inflation data to ease down to 18.5pc which had increased expectations of monetary easing going forward.

“Possibly due to lingering political uncertainty given another resolution was tabled in the Senate seeking a delay in elections,” he added, as the index failed to sustain its gains.

A day earlier, the IMF board had completed its first review of Pakistan’s economic reform programme supported by a $3 billion Stand-By Arrangement (SBA) and allowed the immediate disbursement of $700 million.

This latest disbursement will bring the cumulative total under the arrangement to an impressive $1.9 billion. The financial support provided by the IMF propels global confidence in Pakistan’s commitment to implementing economic reforms.

“Economic activity has stabilised in Pakistan, although the outlook remains challenging and dependent on the implementation of sound policies,” the IMF board observed.

It also said that “continued timely and consistent implementation of programme policies remains critical, with no room for slippage”.

The board reminded Pakistan that it “requires strict adherence to fiscal targets while protecting social spending, a market-determined exchange rate to absorb external shocks, and further progress on structural reforms to support stronger and more inclusive growth”.

Dear visitor, the comments section is undergoing an overhaul and will return soon.