KARACHI: The IMF-driven rally proved shortlived as growing political tensions worried investors compelling them to take profits at elevated levels as a result the benchmark KSE 100-share trimmed early gains. However, it managed to stay in the green territory by the close of trading session on Friday.

Topline Securities Ltd said the equities began trading on a positive note and hit an intraday high of 739 points on the back of approval of the first economic review of Pakistan under the $3bn Stand-By Arrangement by the IMF’s Executive Board, which would lead to the release of $700m tranche.

However, sceptical investors came in to book profit during the closing hours of the trade as they feared news flow regarding upcoming elections may keep the activity in the market volatile.

Ahsan Mehanti of Arif Habib Corporation said that mid-session witnessed selling pressure on prevailing uncertainty over the outcome of the Senate resolution to postpone general elections.

He said surging Pakistan dollar bonds, rising global crude prices and strong rupee, however, helped the index to close in the green.

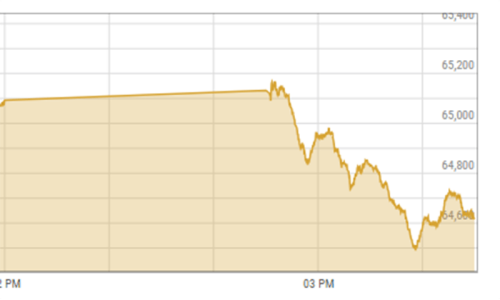

The intraday high and low were recorded at 65,356.85 and 64,491.08 points. The KSE-100 index closed at 64,637.64 points after adding a meagre 20.07 points or 0.03 per cent from the preceding session.

The overall trading volume, however, rose by 9.67pc to 643.30 million shares. The traded value also increased by 17.60pc to Rs20.02bn on a day-on-day basis.

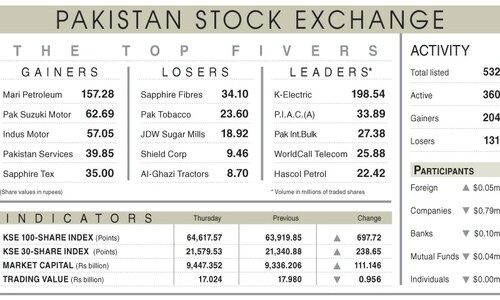

Stocks contributing significantly to the traded volume included K-Electric Ltd (142.50m shares), Pakistan International Bulk Terminal (77.95m shares), Worldcall Telecom Ltd (27.00m shares) Pakistan International Airlines Corporation (26.23) and Pakistan Petroleum Ltd (24.74m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Foods Ltd (Rs299.00), Bhanero Textile Mills Ltd (Rs70.00), Mari Petroleum Ltd (Rs64.87), Philips Morris (Rs41.25) and Pakistan Engineering Ltd (Rs40.47).

Companies registering the biggest decreases in their share prices in absolute terms were Pak Suzuki Motor Company Ltd (Rs63.80), Sapphire Fibres Ltd (Rs49.90), Indus Motor Ltd (Rs24.74), Service Industries Ltd (Rs22.76) and Hallmark Company Ltd (Rs21.99).

Foreign investors were net buyers as they picked shares worth $0.48m.

Published in Dawn, January 13th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.