WASHINGTON: The IMF Executive Board’s decision to disburse around $700 million to Pakistan reflects a positive review of the country’s economic reform programme. While economic activity has stabilised, challenges persist, contingent on the effective implementation of sound policies.

Macroeconomic conditions have shown improvement, with a projected two per cent growth in FY24. The fiscal position strengthened in 1QFY24, achieving a primary surplus of 0.4pc of GDP, driven by strong revenues. Inflation, although elevated, is expected to decline with appropriately tight monetary policy to 18.5pc by end-June 2024.

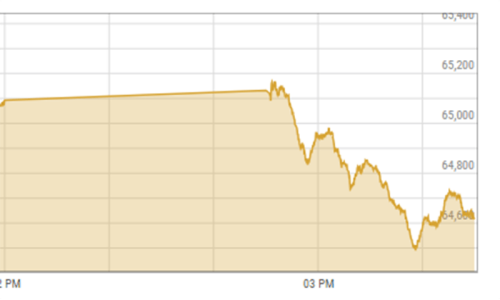

Gross reserves of the State Bank of Pakistan (SBP) increased to $8.2 billion in December 2023, and the exchange rate remained stable.

IMF’s Deputy Managing Director Antoinette Sayeh emphasises the need for “continued strong ownership to maintain momentum in stabilising Pakistan’s economy.”

Acknowledges revenue performance, spending restraint

The authorities’ efforts in revenue performance and federal spending restraint are acknowledged, but challenges, including provincial spending pressures, require ongoing attention. She underlines “the importance of broad-based fiscal reforms to mobilise additional revenues and improve public financial management.”

Challenges identified in the IMF’s statement include high inflation impacting vulnerable groups. The SBP’s tight stance is deemed appropriate, adding that “a market-determined exchange rate is crucial for external shock absorption and rebuilding foreign exchange reserves.”

The statement also underlines addressing undercapitalised financial institutions and ensuring financial sector vigilance, pointing out that these are essential for sustained stability. Ms Sayeh underlines the imperative of job creation and inclusive growth in Pakistan, calling for “the protection of vulnerable groups through programmes like BISP.”

The IMF also stresses the need for structural reforms, improvement in the business environment, and expediting the process of restructuring and reforming state-owned enterprises (SOEs).

In the context of Pakistan’s economic progress, the mention of SOE reform suggests a focus on restructuring and improving the efficiency of state-owned enterprises as part of broader economic reforms. This may require the government to privatise loss-making enterprises. The IMF also suggests governance enhancement and anti-corruption measures, and climate resilience, identified as key drivers for Pakistan’s economic progress.

The positive outlook for Pakistan’s dollar bonds, with investors anticipating another IMF bailout, is intricately tied to the overall narrative of economic progress. Investors find the bonds attractive, expecting gains despite a significant rise in 2023. This optimism is influenced by the commitment to IMF programs and potential reforms, such as adjusting fuel and electricity prices.

The success in meeting IMF demands has contributed to reducing the risk of default in 2024. However, the upcoming elections and the imperative of sustained adherence to the IMF programme are crucial factors influencing this positive outlook. This linkage underscores the interconnected nature of economic indicators, policy decisions, and investor sentiment in shaping Pakistan’s economic landscape.

Published in Dawn, January 13th, 2024