KARACHI: Growing uncertainties amid renewed calls by lawmakers seeking a delay in general elections kept fuelling investor nervousness and overshadowed positive developments on the economic front in the outgoing week. However, the equities managed modest gains to close the second consecutive week of the new year on a positive note.

After adopting a resolution by a thinly-attended Senate session on Jan 5 seeking a delay in general elections on security grounds, the Senate Secretariat on Friday received a fresh resolution demanding a three-month delay on similar grounds.

Arif Habib Ltd, however, said the local market maintained a range-bound trajectory throughout the week. Positive economic developments included the approval of the second Stand-By Arrangement (SBA) tranche by the IMF’s Executive Board, amounting to $700m. This approval is expected to provide crucial economic stabilisation to the country.

Furthermore, the remittances for December 2023 reached $2.4bn, reflecting a substantial 13 per cent year-on-year and 5pc month-on-month increase. Furthermore, there was a notable decline in cut-off yields for the three-year, 5-year, and 10-year Pakistan Investment Bonds (PIBs) by 45 basis points, 44bps and 59bps, respectively.

Meanwhile, the SBP’s reserves declined by $66m to $8.1bn during the week ended on Jan 5. However, the rupee continued its bullish spell against the US dollar closing the outgoing week at Rs280.36 appreciating 0.37pc week-on-week.

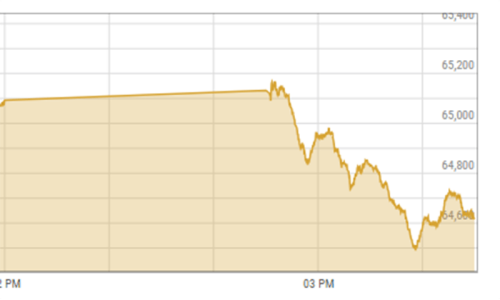

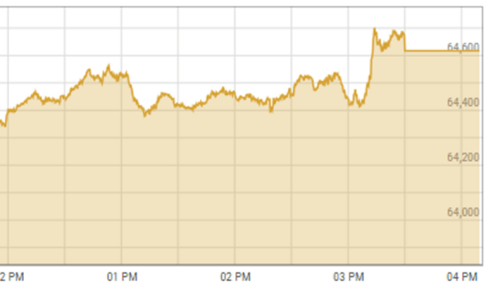

As a result, the KSE-100 index closed at 64,638 points after gaining 123 points or 0.2pc week-on-week.

Sector-wise positive contributions came from oil & gas exploration companies (242 points), fertiliser (214 points), automobile assemblers (56 points), miscellaneous (38 points), and engineering (9 points). Meanwhile, the sectors which mainly contributed negatively were commercial banks (173 points), cement (88 points), technology and communication (84 points), oil and gas marketing companies (38 points), and refinery (27 points).

Scrip-wise positive contributors were Engro Corporation (111 points), Pakistan Petroleum Ltd (106 points), Mari Petroleum Ltd (103 points), Engro Fertisers Ltd (75 points) and Indus Motor Ltd (70 points).

Meanwhile, scrip-wise negative contributions came from United Bank Ltd (58 points), Meezan Bank Ltd (49 points), TRG Pakistan Ltd (35 points), Systems Ltd (32 points), and D.G. Khan Cement (25 points).

Going forward, Arif Habib Ltd expects the index to remain positive in the coming week. The prime minister has written a letter to the UAE government requesting the rollover of a $2bn loan, which is scheduled to mature in the upcoming week. A successful rollover would improve SBP’s foreign reserves position which will boost investor confidence.

Published in Dawn, January 14th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.