KARACHI: Share prices remained on the downward trajectory for the third consecutive session amid continued selling pressure emanating from pre-poll uncertainty and escalation of border tensions with Iran as a result the benchmark 100-share index closed in the red after moving in both directions.

Equities began trading on a positive note on the back of a significant current account surplus, a jump in foreign direct investment in the first half of FY24, a rollover of a $2bn deposit by the UAE government and a landing of $705 million tranche from IMF, but uncertainty about general elections following a flare-up with Iran suppressed the economic positivity which triggered profit-taking.

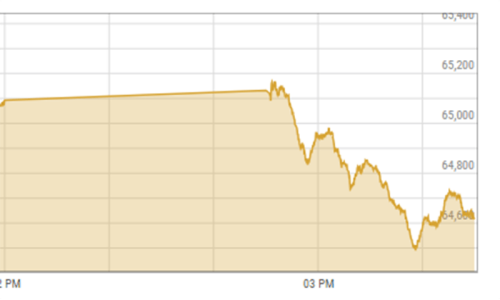

Topline Securities Ltd said equities moved in both directions as bullish and bearish forces confronted throughout the session to take the helm at PSX. However, bears emerged as winners as the KSE 100 index couldn’t sustain the initial gains of 306.41 points hitting intraday peak at 64,043.87. However, the trend reversed on aggressive foreign selling as a result the market recorded the day’s low of 63,290.18 losing 447.28 points.

Ahsan Mehanti of Arif Habib Corporation said amid rising political noise other factors including a slump in global equities, weak crude oil prices and uncertainty over SBP key policy rate announcement played a catalyst role in the bearish close.

However, the KSE-100 index closed at 63,567.34 points after losing 170.13 points or 0.27 per cent from the preceding session.

The overall trading volume, however, edged up 3.38pc to 421.33 million shares. The traded value surged 46.91pc to Rs18.57bn on a day-on-day basis.

Companies registering the biggest decreases in their share prices in absolute terms were Rafhan Maize (Rs401.50), Pak Suzuki Motor Company Ltd (Rs53.74), Pakistan Services Ltd (Rs32.00), National Refinery Ltd (Rs14.47) and Millat Tractors Ltd (Rs10.53).

Foreign investors turned net sellers as they offloaded shares worth $2.21m.

Published in Dawn, January 18th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.