KARACHI: Normalisation of diplomatic ties with Iran and reports about the government’s plan to settle down circular debt revived investors’ interest in the energy sector helping the benchmark KSE 100 share index to close the session near 64,000 on Monday.

Topline Securities said the index commenced the week on a positive note as significant buying momentum was seen during the latter half of the trading session after reports circulated on different media channels regarding the finance ministry’s plan to issue Rs1.25 trillion to settle energy sector circular debt.

The brokerage attributed the rally to the rejuvenated buying interest in energy stocks with both Oil and Gas Development Company Ltd and Pakistan Petroleum Ltd hitting their upper limit for the day.

In addition, Bank Alhabib Ltd also hit the upper circuit after it announced a board meeting on Jan 31 in anticipation of better financial results along with a good dividend.

Ahsan Mehanti of Arif Habib Corporation said in addition to circular debt reports, the International Monetary Fund’s affirmation of satisfactory performance under the $3bn Stand-By Arrangement and strong economic outlook played a catalyst role in bullish close at PSX.

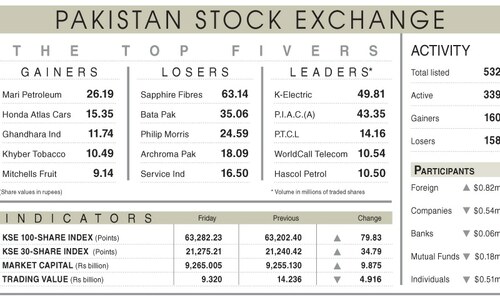

As a result, the KSE-100 index closed at 63,939.41 points after rallying 657.19 points or 1.04 per cent from the preceding session.

The overall trading volume rose 3.9pc to 298.69 million shares. The traded value also jumped 34.27pc to Rs12.51bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (97.70m shares), Pakistan Petroleum Ltd (23.33m shares), Pakistan International Airlines Corporation Ltd (21.10m shares), Oil and Gas Development Company Ltd (16.63m shares) and WorldCall Telecom Ltd (9.87m shares).

Shares registering the biggest increases in their share prices in absolute terms were Nestle Pakistan (Rs70.00), Mari Petroleum Ltd (Rs53.28), Rafhan Maize Ltd (Rs50.00), Service Industries (Rs26.24) and Hoechst Pakistan Ltd (Rs20.00).

Companies registering the biggest decreases in their share prices in absolute terms were Honda Atlas Cars Ltd (Rs20.53), JDW Sugar Mills Ltd (Rs19.00), Al-Ghazi Tractors Ltd (Rs12.50), Pakistan Hotels Developers Ltd (Rs6.76) and Colgate-Palmolive Ltd (Rs7.67).

Foreign investors remained net sellers as they sold out shares worth $0.26m.

Published in Dawn, January 23rd, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.