Shares at the Pakistan Stock Exchange (PSX) traded in the green on Tuesday, gaining more than 500 points amid reports about the government’s plan to settle down circular debt.

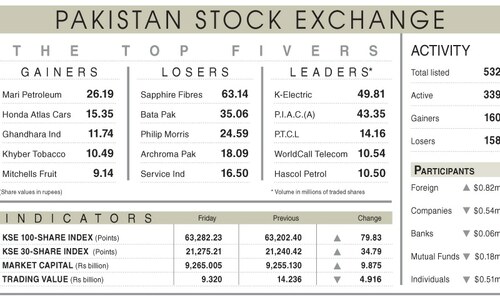

According to the PSX website, the KSE-100 index climbed 473.82, or 0.74 per cent, to stand at 64,413.23 at 12:58pm from the previous close of 63,939.41.

The index continued its upward trajectory and closed at 64,454.22, up by 514.81 or 0.81pc, from the previous close.

Raza Jafri, head of equities at brokerage Intermarket Securities, said that the gains were being driven by energy and bank stocks.

Additionally, he said that investors were continuing to hold out hopes for “circular debt resolution”.

“Good volumes though, so looks like there was good absorption of the initial selling pressure as the market was negative in early trading.” he added.

Yousuf M. Farooq, director of research at Chase Securities, said that the uptick in the market followed “media reports indicating the resolution of circular debt, coupled with the commencement of the corporate results season”.

He also credited the rally to the recent country report from the International Monetary Fund (IMF), saying it had propelled market sentiment.

He highlighted that banking stocks witnessed an upward trend after the IMF suggested a hawkish stance on monetary policy. Additionally, he said, the Oil and Gas Development Company (OGDC) also experienced a surge “driven by media reports of a substantial cash injection into the system to address circular debt”.

However, despite positive developments, Farooq noted that the “market continued to be undervalued compared to regional peers”.

He cautioned that uncertainty surrounding upcoming elections and the country’s political future were a source of apprehension for investors which resulted in market volatility.

Dear visitor, the comments section is undergoing an overhaul and will return soon.