The Pakistan Stock Exchange (PSX) on Wednesday managed modest gains, a day after losing 900 points as foreign selling eased.

On Tuesday, the stock market had posted another major decline of 1.5 per cent due to investor concerns over political noise and security unrest in the country. It was the fourth consecutive drop on the market, with the KSE-100 index having lost nearly 3,000 points since last Wednesday.

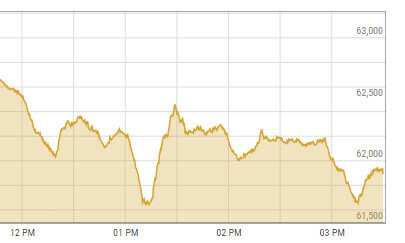

Today, the KSE-100 index gained 426.48, or 0.69 per cent, to stand at 62,268.22 from the previous close of 61,841.74. The index closed at 61,979.18, up by 137.44, from the previous close of 61,841.74.

Mohammed Sohail, chief executive of Topline Securities, cited “ease in foreign selling” as the primary reason for market rebound.

Tahir Abbas, head of research at Arif Habib Limited, said that market remained bullish as the foreign-selling witnessed in the last three to four days eased.

He added that the recent correction made the valuations more attractive, coupled with “spectacular results announcement by companies” had enticed investors.

Khaldoon bin Latif, chief executive of Alfalah Asset Management Limited, said that a leading global exchange-traded fund (ETF) had “announced the scheduled liquidation of multiple ETFs”, including in Pakistan.

An ETF is a bundle of assets that can be traded on the stock market. Traded on the exchange like an ordinary stock, ETFs let investors take exposure to a basket of companies while combining high returns of direct stock investing with the diversified base offered by mutual funds.

Latif attributed the fall in capital markets over the last few days due to “this outflow from the ETF”.

“With the ETF liquidation almost complete, the market has rebounded as corporate earnings and energy reforms come back into the forefront,” he said.

“With strong earnings growth expected in multiple sectors, especially the banks, market is expected to recover going forward,” he added.

Dear visitor, the comments section is undergoing an overhaul and will return soon.