Bulls dominated the trading floor of the Pakistan Stock Exchange (PSX) on Tuesday as shares gained nearly 800 points due to activity reported in the energy sector.

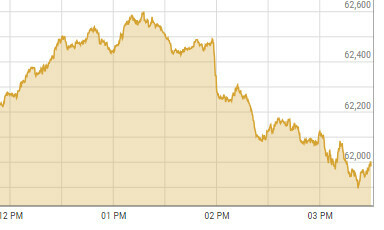

According to the PSX website, the KSE-100 index gained 659.15 points to stand at 63,662.06 at 1:42pm, up 1.05 per cent from the previous close of 63,002.91.

Continuing the upward momentum, the index eventually closed at 63,799.01, up by 796.10 or 1.26pc.

Mohammed Sohail, chief executive of Topline Securities, attributed the bullish activity to reports on the energy sector’s circular debt coupled with “pre-election buying”.

Several media outlets have reported that the caretaker government has begun negotiating with the International Monetary Fund (IMF) on proposals for the settlement of the circular debt.

Faran Rizvi, head of equity sales at JS Global, said, “The market is likely to experience a rally in the oil and gas sector due to the resolution of the circular debt issue.”

However, he advised caution as the upcoming elections remain a “significant market driver”, urging them to anticipate a “potential short correction before the polls”.

“In the long term, our outlook on the PSX is bullish,” he said.

Awais Ashraf, director of research at Akseer Research, noted that the KSE-100 index rallied on the “probability of resolution of circular debt through one-time cash dividend and the likelihood of continuation of electricity at a subsidised rate for industries”.

Moreover, he said that the increase in prices for Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipelines Limited (SNGPL) by the Oil and Gas Regulatory Authority (Ogra) resulted in a positive momentum.

Shahab Farooq, director of research at Next Capital Limited, said that as the government approached the IMF to greenlight its circular debt reduction plan, it was anticipated that the resolution would eventually lead to big dividends by state-owned exploration and production (E&P) companies.

He noted that the market reacted positively with listed state-owned E&P companies, in addition to other energy sector stocks.

However, he added that other stocks “remained lacklustre amid the election taking place on Feb 8”.

“Post-election performance of the market is expected to be positive, barring any unforeseen event,” he added.

Meanwhile, Tahir Abbas, head of research at Arif Habib Limited, credited the upward trajectory to “strong corporate results and dividend announcements, along with expectations of clearance of energy sector circular debt”.

Dear visitor, the comments section is undergoing an overhaul and will return soon.