Bears dominated the Pakistan Stock Exchange (PSX) on Thursday as shares witnessed a spike in selling pressure, with analysts attributing the losses to “ambiguity on the political landscape”.

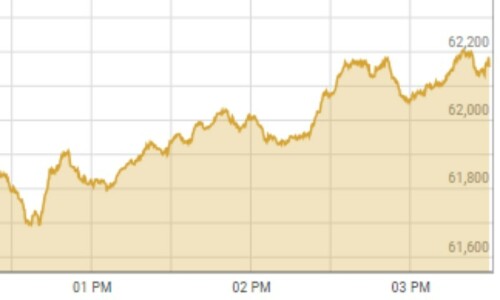

According to the PSX website, the KSE-100 index lost 936.97, or 1.51 per cent, to stand at 61,216.87 at 2:52pm. It finally closed at 61,020.05, down 1133.79 or 1.82pc from the previous close of 62,153.84 points.

The index was fairly stable during trading before 2:30pm. The losses had coincided with the PTI saying it would announce a date for countrywide protests against alleged rigging in the Feb 8 polls.

On Wednesday, the index had rallied following a formal announcement by PML-N and its allies, including the PPP, for the formation of a coalition government which restored investor confidence. As a result, the KSE-100 index partially recovered the overnight losses and settled above the 62,000 level.

Speaking to Dawn.com today, Tahir Abbas, head of research at Arif Habib Limited, said: “The market is reacting negatively amid ambiguity on the political landscape.”

Additionally, he attributed the bearish momentum to “companies with high dependency on natural gas” as the cost of production was expected to increase given the gas tariff hike, which would result in lower margins and profitability.

It should be mentioned that the caretaker government on Wednesday allowed another up to 45pc increase in the natural gas tariff with effect from Feb 1 to meet the revenue requirement of the gas utilities targeted for the current year.

Shahbaz Ashraf, chief investment officer at FRIM Ventures, credited the losses primarily to “unclarity on the political set-up going forward”.

Shahab Farooq, director of research at Next Capital Limited, said that the market was starting to focus on the “imminent challenges ahead”, particularly the next government’s task of negotiating with the International Monetary Fund (IMF) for a new and bigger programme as deemed necessary for external account sustainability.

However, a new IMF programme was expected to follow “more stringent conditions” which has made equities move down with low participation, he added.

Dear visitor, the comments section is undergoing an overhaul and will return soon.