KARACHI: Bears took over the trading floor of the Pakistan Stock Exchange on Thursday after Pakistan Tehreek-i-Insaf nominated candidates for prime minister and Punjab chief minister as it also started contacts with different parties for the formation of coalition governments.

Also, the Pakistan Peoples Party’s reluctance to join Shehbaz Sharif’s cabinet despite announcing support to elect him as prime minister drew strong reactions from the PML-N camp deepening political uncertainty as a result the benchmark KSE 100-share index came under selling pressure wiping out overnight gains.

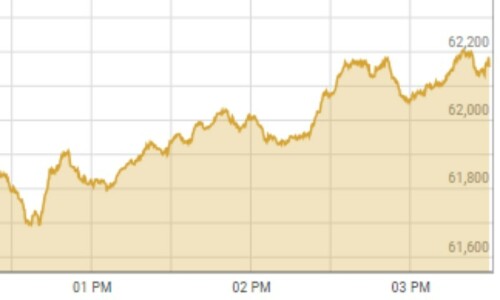

Topline Securities Ltd said equities began trading on a positive note and stayed in the green zone for most of the time as the index made an intraday high at 62,394 level (240 points).

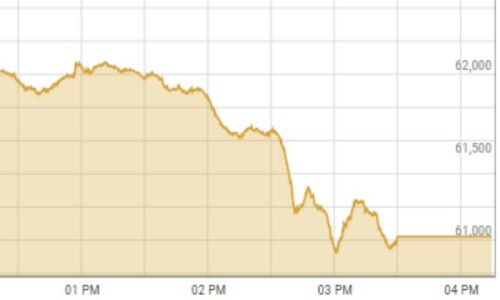

However, it started to come off sharply after news reports on different media channels regarding PTI engaging in talks with different parties to form governments in the centre and Punjab. This development knocked down the market’s positive momentum with a feather.

Exploration and production, power, bank and fertiliser sectors contributed negatively to the index as Oil and Gas Development Company Ltd, Pakistan Petroleum Ltd, Hub Power, UBL and Engro Corporation lost 438 points, cumulatively.

Ahsan Mehanti of Arif Habib Corporation said default risks amid political instability, policy uncertainty and massive gas price hike delivered by the ECC to meet an IMF deadline to recover an additional Rs242bn from gas consumers, mainly industries played a catalyst role in bearish close.

As a result, the KSE-100 index closed at 61,020.06 points after tumbling by 1,133.78 points or 1.82 per cent from the preceding session.

The overall trading volume rose 13.57pc to 345.12 million shares. The traded value also increased 19.15pc to Rs11.87bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan K-Electric (33.32m shares), Pakistan International Airlines Corporation (28.60m shares), Media Times Ltd (22.42m shares), Hascol Petroleum Ltd (15.87m shares) and Bank of Punjab (12.02m shares).

Companies registering the biggest decreases in their share prices in absolute terms were Mari Petroleum Ltd (Rs54.67), Mehmood Textile Mills Ltd (Rs42.76), Indus Motor Company Ltd (Rs40.99), Pakistan Tobacco Company Ltd (Rs40.00) and JDW Sugar Mills Ltd (Rs24.49).

Shares registering the biggest increases in their share prices in absolute terms were Rafhan Maize Ltd (Rs223.75), Philip Morris (Rs11.50), Sazgar Engineering Ltd (Rs11.26), Pakistan Hotels Developers Ltd (Rs5.93) and Ellcot Spinning Mills Ltd (Rs5.78).

Foreign investors turned net sellers as they offloaded shares worth $0.45m.

Published in Dawn, February 16th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.