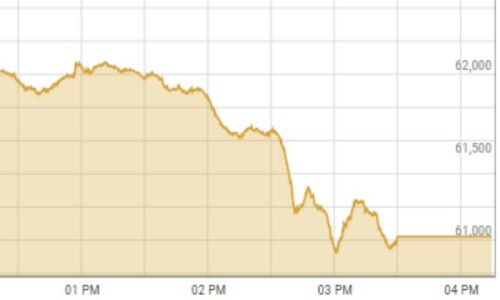

Shares at the Pakistan Stock Exchange (PSX) traded in the red on Friday, with stocks plunging by more than 1,000 points by day’s end as analysts attributed the losses to continued uncertainty on the political front.

At 12:09pm, the benchmark KSE-100 index plunged by 984.38, to reach 60,035.67 from the previous close of 61,020.05 points. When trading ended, it had fallen further, cumulatively by 1,000.85 points (1.64 per cent), closing at 60,019.20 points.

Yesterday, the bears took over the trading floor after the PTI nominated candidates for prime minister and Punjab chief minister and started contacts with different parties for the formation of coalition governments.

Also, the PPP’s reluctance to join PML-N leader Shehbaz Sharif’s cabinet despite announcing support to elect him as prime minister drew strong reactions from the PML-N camp, deepening political uncertainty due to which the benchmark index came under selling pressure wiping out overnight gains.

Speaking to Dawn.com, Mohammed Sohail, chief executive of Topline Securities, attributed today’s bearish momentum to “uncertainty over the formation of a new coalition” which forced leveraged players to trim their position.

Awais Ashraf, director of research at Akseer Research, said that the expected formation of a “weak coalition government in the Centre” and protest calls by the PTI and other parties had raised questions regarding the implementation of tough reforms needed for economic recovery.

“Subsequently, state-owned entities remained under pressure and dragged the KSE-100 index into negative territory.” he added.

Yousuf M. Farooq, director of research at Chase Securities, noted that the Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) experienced selling pressure due to a delay in the circular debt resolution, in addition to political uncertainty.

It should be mentioned that the interim government on Thursday allowed another 45 per cent increase in natural gas prices to oblige the International Monetary Fund (IMF) and meet revenue requirement of the gas utilities targeted for the current year.

Farooq further said that the gas price hike made market participants concerned about inflationary pressure.

Dear visitor, the comments section is undergoing an overhaul and will return soon.