KARACHI: Equities witnessed another bullish day on the stock exchange as investors reacted positively to the beginning of the government formation process and the International Monetary Fund’s readiness to engage with the new administration propelling the KSE benchmark above the 62,000 level.

Speaking to Dawn, Pak-Kuwait Investment Company’s Head of Research Samiullah Tariq said the IMF’s statement has ended the uncertainty about the start of the second review next week or early March under the current $3bn Stand-By Arrangement.

He said the report that the new government would seek a new $6bn Extended Fund Facility, which is considered crucial for Pakistan meeting its debt repayment obligations, further boosted the market sentiments.

Topline Securities Ltd said investor confidence has improved as things were moving smoothly towards the formation of governments in the Centre and provinces as newly elected representatives were sworn into the Punjab assembly while Sindh assembly’s first session would take place on Saturday.

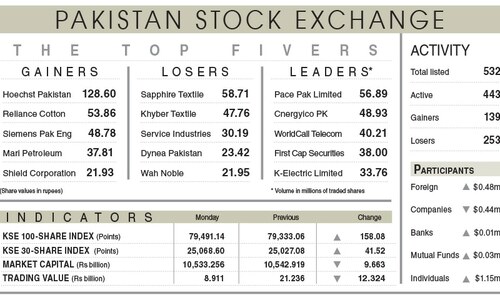

As a result, the KSE-100 index closed at 62,815.82 points after rallying 901.48 points or 1.46 per cent from the preceding session.

The overall trading volume increased by 16.36pc to 377.97 million shares. The traded value also rose by 14.63pc to Rs16.01bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Kohinoor Spinning Mills Ltd (36.16m shares), K-Electric (26.53m shares), Yousuf Weaving Mills Ltd (16.72m shares), Oil and Gas Development Company Ltd (16.61m shares) and WorldCall Telecom Ltd (15.53m shares).

Shares registering the biggest increases in their share prices in absolute terms were Mari Petroleum Ltd (Rs52.02), Hoechst Pak (Rs29.00), Hallmark Pakistan Ltd (Rs26.24), Murree Brewery (Rs25.31) and Indus Motor Company Ltd (Rs22.33).

Companies registering the biggest decreases in their share prices in absolute terms were Reliance Cotton Spinning Mills Ltd (Rs39.88), Siemens Pakistan Ltd (Rs13.63), Jubilee Life Insurance Ltd (Rs10.89), Highnoon Laboratories (Rs9.50) and Biafo Industries Ltd (Rs8.49).

Foreign investors remained net buyers as they picked shares worth $2.24m.

Published in Dawn, February 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.