KARACHI: Extending a yet another major relief to cash-strapped Islamabad, the Chinese government has rolled over its $2 billion loan, which was due in March, for one year.

The finance ministry on Thursday confirmed that China has accepted Pakistan’s request for the rollover, considering the country’s current inability to repay the loan.

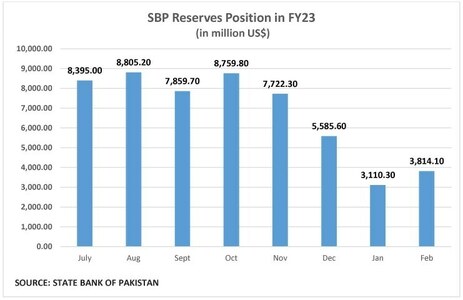

Most of the foreign exchange reserves of the State Bank of Pakistan (SBP) consist of loans from friendly countries. The central bank, which used to provide dollars for debt servicing, is now practically unable to repay foreign loans.

The caretaker government, which managed to develop relations with the IMF under tough conditions and received $1.8bn under the Stand-By Arrangement, failed to improve foreign exchange reserves or devise a strategy for their increase.

SBP holdings fall below $8bn, sparking concerns amid dried-up inflows and lagging remittances

In mid-June 2023, China provided a $1bn loan to Pakistan. In fact, Pakistan repaid the amount, and China returned it upon the country’s request.

The rolled over of $2bn will help Pakistan maintain a reasonable figure for foreign exchange reserves. However, the latest report from the SBP on Thursday showed that the reserves of the fell below $8bn. This must be a serious concern for the government, as inflows have dried up, remittances are still behind last year’s figures, exports of the core textile sector are falling, and talks with the IMF for new loans have yet to initiate.

Media reports suggest that the government plans to initiate talks with the IMF for $6bn in loans. The new political government will face this challenging task, as emphasised by the caretaker Finance Minister Dr Shamshad Akhtar, who reiterated several times that the country needs to remain in the IMF programme for economic sustainability.

According to the SBP, reserves decreased by $63 million to $7.949bn during the week ending on 23 Feb due to debt repayments. Financial market concerns arise as this trend could impact the exchange rate, which has been stable for over two months, providing positive signals for investors. Foreign investors have significantly increased investments in equities and treasury bills during this period.

Since Dec 2023, the SBP has maintained $8bn in foreign exchange reserves. Although reserves fluctuated during this period, they did not fall below $8bn. However, this week’s outflow brought the reserves below $8bn, while the IMF aims to see reserves at $9 billion by the end of June 2024.

Informed sources in the Ministry of Finance are confident that the country will receive the third tranche of $1.2bn by the end of March or April this year. This will increase the reserves of the SBP, but simultaneously, more foreign debt servicing will require dollars. During FY24, the country needs to pay about $25bn for debt servicing. The government is attempting to roll over bilateral debts, pay the minimum, and negotiate further delays for payments.

“The most daunting situation is that the country will need another $25bn or more in the next fiscal year, FY25,” said a senior analyst.

Published in Dawn, March 1st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.