KARACHI: Political stability with the smooth formation of new provincial governments in the four provinces, deceleration of inflation and strong corporate results helped the stock market to turn in another robust weekly performance.

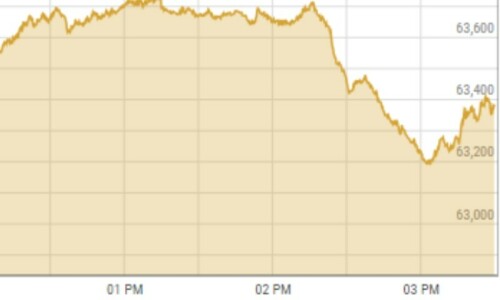

Arif Habib Ltd said the market continued its positive momentum as the benchmark KSE 100-share index witnessed a surge from last week’s closing of 62,816 to above 65,000, reflecting investor optimism amid the ongoing government formation process.

With the swearing-in of the MNAs-elect and subsequent election of the NA speaker and the impending vote for a new prime minister on Sunday, the market has responded positively to expectations of political stability and government formation.

The rollover of a $2bn loan by China helped the State Bank of Pakistan to maintain its holdings at a reasonable level. However, the SBP reported its forex reserves decreased by $63m to $7.9bn during the week ended on Feb 23.

Additionally, the Federal Board of Revenue collected Rs681bn in February against the projection of Rs714bn, reflecting a massive shortfall of Rs33bn. During the week the rupee closed at 279.19 against the US dollar, appreciating by Rs0.17 or 0.06pc week-on-week.

On the economic front, the trade deficit narrowed by 30pc during the first eight months of FY24 and the headline inflation decelerated to 23.1pc in February from 28.34pc in the preceding month. This unexpected massive decline in CPI-based inflation hitting a 20-month low revived hopes of the market for an interest rate cut in the upcoming monetary policy review from the unprecedented 22pc.

Hence, the market closed at 65,326 points, surging 2,510 points or 4pc week-on-week.

Sector-wise positive contributions came from commercial banks (806 points), fertiliser (777 points), oil & gas exploration (280 points), auto assembler (184 points) and cement (159 points).

Meanwhile, the sectors which mainly contributed negatively were technology (37 points), pharmaceuticals (28 points), leather & tanneries (24 points), and cable and electrical goods (11 points). Scrip-wise positive contributors were Engro Corporation (279 points), Engro Fertilisers Ltd (211 points), Meezan Bank Ltd (182 points), Millat Tractor Ltd (160 points) and Mari Petroleum Ltd (160 points). On the flip side, negative contributions came from TRG Pakistan (51 points), Oil and Gas Development Company Ltd (37 points), Service Industries Ltd (24 points), Pak Elektron Ltd (11 ponits) and Abbott Laboratories Ltd (11 points).

Foreign buying continued during the outgoing week, clocking in at $10.5m compared to a net buy of $2.9m last week. Major buying was witnessed in commercial banks ($4.0m) and all other sectors ($3.4mn). On the local front, selling was reported by banks/DFIs ($6.4m) followed by insurance companies ($3.7m). Average volume rose 24pc to 419m shares while the average value traded increased 23pc to $56m week-on-week.

Going forward, the market is expected to maintain a positive outlook next week with the election of the new prime minister.

According to AKD Securities Ltd, successful completion of the second review under the current IMF $3bn Stand-By Arrangement would provide a crucial financial cushion against the upcoming $1bn Eurobond payment scheduled for April 15. Overall, funding requirements for the rest of the months in the current fiscal year seem to remain on track.

The new government is likely to enter into a fresh Extended Fund Facility by May assuming political noise dies down and a decision on a minister for finance is made.

Published in Dawn, March 3rd, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.