IN the days and weeks following the elections, the view held by Pakistan’s creditors seems to be clearing up. All the notes released on Pakistan since the elections point to the IMF as the single most important factor in the country’s short-term creditworthiness, and all of them revolve around the question of whether or not the incoming government will move clearly and decisively to secure another Fund arrangement. Most of them see political risks receding.

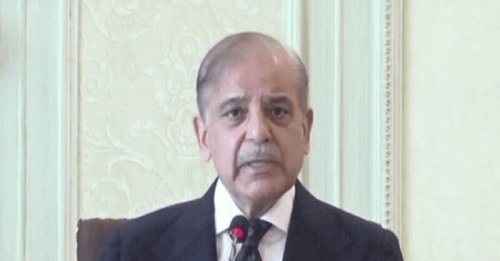

Given the very high levels of external debt Pakistan is carrying, this is only natural. But the markets, for the most part, see political risk subsiding after the elections. The fact that the new prime minister met his economic team within hours of his swearing in and that leaks from inside that meeting said he expressed a desire to move swiftly on the IMF deal will further help restore some trust in Pakistan’s economic management.

For now, the creditors seem to be breathing a bit easier, with a few exceptions, in contrast to the rollercoaster ride they have been through in the past two years. Prices of all Pakistani bonds, with maturities ranging from April ’24 to August ‘51, have risen since the elections, the clearest possible signal that confidence is returning to Pakistan’s story, in the eyes of its private sector external creditors.

“The elections-related political uncertainty is falling,” said the Bank of America in a note circulated to its clients early last week, advising them to start buying bonds maturing in ’26 until they touch 83 cents on the dollar. As of when this column was being written, those same bonds were being quoted slightly above that level. The note further states that after the billion-dollar bond maturing in April, “near-term commercial debt maturities are about $1bn until early ’26, which is too small to trigger a credit event”.

The markets, for the most part, see political risk subsiding after the elections.

JP Morgan was a little more restrained a few days later. Noting the price increases all bonds have seen since the elections, they advised their clients to stand down for now. “Dust has settled,” their note said, once the formation of the government was announced, “but political risk has increased”. It noted the emergence of a “hung parliament” following the elections and the strong performance of the PTI-backed independents.

The note saw a higher likelihood of protests marring the functioning of parliament, and argued that the PML-N has emerged weakened and “could face challenges in steering the coalition government towards the goal of negotiating for a new IMF programme”. Even if a programme is achieved, it continued, implementation could still be weakened.

Between these two positions, there is a whole set of views. A week before either of these notes, Barclays had described the situation in Pakistan as “choppy” but advised its clients to “look through noise”.

“In our view, risks regarding a payment halt have meaningfully receded, and we expect the newly elected government to engage with the IMF for another programme” before drawing up the next budget for FY25. The note said default on Eurobonds no longer looks like a possibility, and advised clients to buy “on weakness” without suggesting a price. The same note pointed to improvements in the external sector, indicating that external financing requirements till the end of FY25 have been reduced by $8bn, the reserve cover has improved to three months of imports with a sharp rise in gross reserves from last year, and the current account deficit is projected to come in within target at 1.6 per cent of GDP as FY24 ends.

Goldman Sachs saw an upside in Pakistan in a note last week, not just related to bonds, but to currency as well. It flagged two main risks — the end of the IMF programme in April that will need to be renewed immediately, and the overall low revenue base, the low export base, and the inability of the country to sustain its own growth. They noted that Pakistani bonds have “one of the highest returns in the EMBI Global Diversified Index last year” but are still rated as distressed due to the underlying economic weaknesses of the country.

In a credit note released on March 6, however, Moody’s took a more downbeat view of Pakistan’s external sector vulnerabilities. The country’s low reserves and high financing needs “imply material default risks if there were delays in funding from the IMF and other partners”, their note said. They also pointed to “social pressures and weaknesses in governance” that could hamper programme implementation. But the agency did not change the credit rating it has assigned to Pakistan — CAA3 with a stable outlook. It did suggest that a rating upgrade could come with a “sustainable increase in foreign exchange reserves” and continued fiscal consolidation.

Another rating agency, Fitch, released its note earlier than all the others — Feb 19 — and saw more political risk than the others. “We believe a government will assume office and engage with the IMF relatively quickly, but risks to political stability are likely to remain high,” their note said. “Public discontent could rise further if PTI remains sidelined — the election revealed continued strong public support for the party.”

All of last week, one after another financial institution released their notes on Pakistan’s outlook following the elections. The overall tone of these notes is clear. Most of them see political stability returning once the government is formed, and economic stability returning once a successor IMF programme is signed. All of them highlight the underlying vulnerabilities that will remain in place, and the weakened position from where the new government will have to address them.

For now, the default risk is not as near as it was the same time last year, but the underlying vulnerabilities are making a change in credit rating difficult. Cabinet appointments are being watched carefully by everyone. A cautious confidence is returning. But for it to be anchored, deeper structural changes will be required. That will be the government’s biggest challenge.

The writer is a business and economy journalist.

Published in Dawn, March 7th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.