KARACHI: The formation of a new government and positive signals from the International Monetary Fund have brought down the dollar to a five-month low against the rupee, reflecting a growing confidence in the stability of the exchange rate.

For the last three months the exchange rate remained stable at close to Rs 280 in the interbank market. In fact, the rupee has kept rising inch by inch against the greenback during this period.

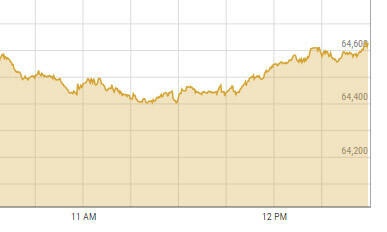

The dollar rate was Rs278.80 on Oct 20 last year, but it remained above this rate over the next five months. However, it fell to Rs278.77 on Thursday. The rupee appreciated 29 paisa on Wednesday and two paisa on Thursday.

Market experts said the market sentiment picked up after the new finance minister’s statement that the IMF had set no new condition for release of the third tranche of the $3billion Stand-By Arrangement.

Sources in the financial sector welcomed the appointment of Mohammad Aurangzeb as the finance minister, saying his predecessor Ishaq Dar was no longer in the agency’s good books.

Pakistan relies heavily on IMF support to meet its huge debt servicing commitments, which require a staggering $25bn in FY25. An external funding of $6bn is still needed to meet the debt servicing commitment for FY24.

Unpopular decisions

Islamabad is willing to initiate talks with IMF for other loans up to $6bn. Experts and independent economists are confident that the agency would support Pakistan since the country had fulfilled almost all conditions for the SBA.

There is a consensus among stakeholders that Prime Minister Shehbaz Sharif would not hesitate to implement unpopular decisions to secure IMF loans, recalling that he took harsh decision during his previous stint in power. These measures hit the masses and dented his popularity.

The caretaker government drastically slashed imports to keep the exchange rate stable, bringing down the twin deficits in trade and current account.

This massive cut in imports hit economic growth, pushing it into the negative zone.

Currency experts estimate remittances would go up by 15 to 20 per cent during Ramazan. They are hopeful this increase, coupled with the expected release of IMF’s last tranche of $1.1bn, will go a long way in strengthening the exchange rate.

Exporters have been selling their proceeds instead of holding for a longer period to get the maximum benefit, according to bankers. They said the forward premium on export proceeds is also coming down, but slowly.

Market experts see the lowering of forward premium as a sign of exporters’ confidence in the exchange rate.

Meanwhile, the central bank reported on Thursday that its foreign exchange reserves rose by $17 million to $7.9bn during the week ended on March 8. The reserves had recorded outflows during the couple of weeks before March 8.

The SBP’s reserves are now enough to fund imports for 1.6 months, but the country needs to have enough money in the bank to meet import requirements for three months.

The total foreign exchange reserves rose by $131m to $13.2bn, while deposits with commercial banks increased by $114m to $5.2bn during the same week.

Published in Dawn, March 15th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.