KARACHI: The stock market turned in a cautious performance on Monday ahead of the monetary policy announcement as a result the benchmark index managed to post modest gains with a sharp contraction in the trading volume.

Topline Securities Ltd said the equities kicked off the week on a positive note as the benchmark KSE 100 index rose 332 to 65,148 points in early trade amid hopes of a positive outcome of the ongoing IMF final review under the current $3bn Stand-By Arrangement, which would pave the way for the release of last tranche of $1.1bn.

However, the uncertain interest rate outlook unsettled a section of investors who resorted to profit-taking at the day’s high level resultantly the index lost some of its initial gains.

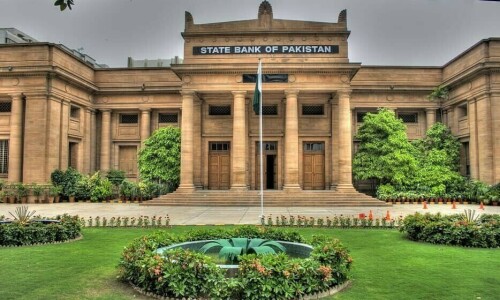

The equity investors adopted a cautious approach ahead of the monetary policy announcement, which was to be unveiled later in the day. A majority of market pundits were expecting a status quo given the ongoing IMF review of the economy and spike in Ramazan-driven inflationary pressure.

Fertiliser, banks and power sectors contributed positively to the index as Fauji Fertiliser Company, Meezan Bank Ltd, Hub Power, United Bank Ltd Dawood Hercules cumulatively added 141 points to the index. On the other hand, Lucky Cement, Systems Ltd and MCB Bank came under heavy selling wiping out 72 points.

Ahsan Mehanti of Arif Habib Corporation said the surging global crude oil prices and strong rupee helped the market to remain in the green.

As a result, the KSE-100 index closed at 64,890.51 points after gaining 74.04 points or 0.11 per cent from the preceding session.

The overall trading tumbled 18.35pc to 211.75 million shares. The traded value also declined 23.07pc to Rs7.78bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom (16.60m shares), Hascol Petroleum Ltd (16.26m shares), Telecard Ltd (14.67m shares), PTCL (13.81m shares) and K-Electric (12.95m shares).

Shares registering the biggest increases in their share prices in absolute terms were Pakistan Hotels (Rs19.98), Pakistan Tobacco (Rs11.00), Thal Ltd (Rs8.98), KASB Pumps (Rs5.20) and Bolan Castings (Rs6.46).

Companies registering the biggest decreases in their share prices in absolute terms were Ismail Industries (Rs60.00), Sapphire Fibres Ltd (Rs35.83), JDW Sugar (Rs20.90), Colgate Palmolive (Rs19.17) and Sazgar Engineering (Rs15.64).

Foreign investors remained net buyers as they purchased shares worth $0.39m.

Published in Dawn, March 19th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.