KARACHI: Equity prices staged a strong rebound at the Pakistan Stock Exchange on Tuesday thanks to the policy rate status quo and optimism about the imminent Staff-Level Agreement with the IMF following the wrapping of the final review.

The State Bank of Pakistan’s decision to maintain the policy rate at 22pc for the sixth consecutive monetary policy review boosted the market confidence as enthusiastic investors picked shares at attractive levels triggering an across-the-board buying spree.

Topline Securities Ltd said the KSE-100 index opened on a positive note as it gained 734.22 points in early trade. Furthermore, whispers of institutional buying circulated, casting a favourable light on the market and contributing to its upward momentum.

A widespread surge of buying activity swept through the market, with banks, fertiliser and exploration & production sectors emerging as the day’s primary beneficiaries where MCB Bank, Meezan Bank Ltd, HabibMetro Bank, Bank Al-Habib, Engro Fertilisers, Fauji Fertiliser Company, Pakistan Oilfield Ltd and Mari Petroleum cumulatively contributed 319 points to the index.

Ahsan Mehanti of Arif Habib Corporation said Pakistan’s targeting of terrorist hideouts inside Afghanistan also boosted market sentiments.

He added that the reports about the SBP Governor’s assurance for a $2bn rollover in two weeks and plans to seek $4bn further payment rollovers played a catalyst role in the bullish close at the PSX.

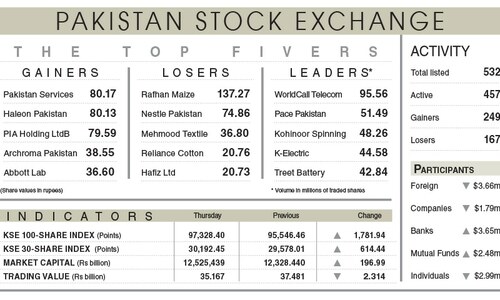

As a result, the KSE-100 index closed at 65,502.60 points after staging a rally of 612.09 points or 0.94 per cent from the preceding session.

The overall trading volume swelled 52.66pc to 323.28 million shares. The traded value also surged by 119.12pc to Rs17.05bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom (27.82m shares), Telecard Ltd (20.82m shares), The Bank of Punjab (17.91m shares), Hascol Petroleum Ltd (16.62m shares) and Unity Foods Ltd (15.91m shares).

Shares registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs200.00), Pakistan Tobacco (Rs67.20), Indus Motor Ltd (Rs48.58), Mari Petroleum Ltd (Rs47.90) and Mehmood Textile (Rs16.82).

Companies registering the biggest decreases in their share prices in absolute terms were Sapphire Fibres Ltd(Rs91.67), Nestle Pakistan (Rs80.00), Ibrahim Fibres (Rs29.92), Murree Brewery (Rs6.48) and Dawood Lawrencepur (Rs5.62).

Foreign investors remained net sellers as they offloaded shares worth $1.65m.

Published in Dawn, March 20th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.