Bullish momentum continued at the Pakistan Stock Exchange (PSX) on Wednesday as shares gained over 200 points after Pakistan and the IMF reached a staff-level agreement.

The KSE-100 index started on a positive note after the bell, climbing more than 400.04, or 0.61 per cent, to stand at 65,902.63 points from the previous close of 65,502.59.

Finally, the index closed at 65,731.79, up by 229.20 points from the previous close.

Mohammed Sohail, chief executive of Topline Securities, attributed the upward trajectory to the “massive buying yesterday by the insurance sector”, adding that the International Monetary Fund (IMF) approval helped propel sentiments.

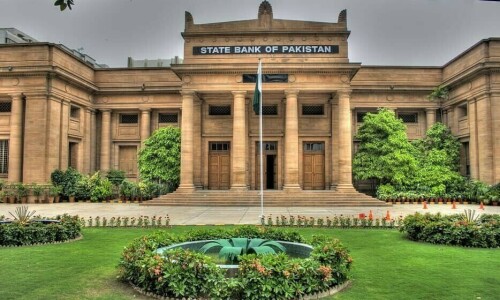

Earlier today, the IMF reached a staff-level agreement with Pakistan on the final review of a $3 billion bailout, where the country will receive $1.1 billion after approval from the Fund’s Executive Board in late April.

“Pakistan’s economic and financial position has improved in the months since the first review, with growth and confidence continuing to recover on the back of prudent policy management and the resumption of inflows from multilateral and bilateral partners,” IMF’s mission chief, Nathan Porter, said in a statement.

Yousuf M. Farooq, director of research at Chase Securities, observed that the positive momentum was “in line with with expectations”.

He added, “Market participants were expecting a smooth review with the IMF after the appointment of the new finance minister and the completion of all targets.”

Awais Ashraf, director of research at Akseer Research, said, investor sentiment was propelled by the staff-level agreement for the release of $1.1 billion with the IMF.

He added, “The agreement ensures the new government’s commitment to continue the policy efforts”.

“Exploration and production, oil marketing and gas distribution companies along with banks are going to be the main beneficiary of the reforms stressed by the IMF,” he said.

Meanwhile, most Pakistan dollar bonds were trading higher on Wednesday after the deal was announced.

The 2027-maturing bond was up 0.25 cents at 83.957 cents on the dollar while the 2025 bond which was up 0.21 cents at 92.023 cents on the dollar.

Additional input from Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.