Bulls dominated the trading floor of the Pakistan Stock Exchange (PSX) on Wednesday as shares gained over 600 points, with analysts attributing the gains to “good progress” made regarding the privatisation of Pakistan International Airlines (PIA).

On Tuesday, the federal cabinet approved the board of PIA Holding Company, with former State Bank governor Tariq Bajwa being appointed as its chairman.

The move was hailed as a significant development in the national carrier’s privatisation process as its liabilities and assets will be transferred to the holding company, which will be registered with the Securities and Exchange Commission of Pakistan. The board will include seven independent directors and four government officials.

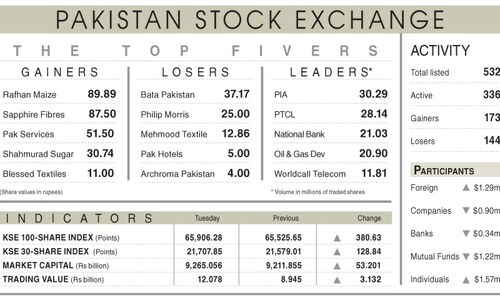

Today, at 11:14am, the benchmark KSE-100 index gained 520.58 points from the previous close of 65,906.27. By 1:43pm, it advanced by a further 143 points, cumulatively gaining 663.71 points to reach 66,529.98 points, or 1.01 per cent ahead.

Finally, the index closed at 66,547.78 points, up by 641.51 or 0.97pc, from the previous close.

It should be noted that that the index crossed the all-time high record of 66,426.78 points previously set on December 12.

Mohammed Sohail, chief executive of Topline Securities, said “good progress” made regarding the privatisation of the national carrier and a “likely new deal with the International Monetary Fund (IMF)” was helping market sentiment.

He highlighted that the benchmark index was once again closing in on the all-time high number of 66,427 points, which was seen in December.

Moreover, he said that foreign fund buying — as shown by National Clearing Company of Pakistan Limited (NCCPL) data — also supported share prices “which are trading at an attractive price-to-earning ratio of less than four”.

He said that currently the country’s market was the best performing market with the highest gains in last six months.

Shahab Farooq, director of research at Next Capital Limited, attributed the rally to “positive developments” on the macroeconomic front such as the progression of PIA’s privatisation and moving ahead with the new IMF deal.

“The finance minister’s statement regarding interest rates and foreign buying are [also] fueling positive sentiments in the market,” he said.

In an interview earlier this month, the finance minister had talked about the need for getting “our house in order by reducing government expenditure”. He had also expressed the hope that the credit rating of the country would improve, and macroeconomic stability would follow.

Yousuf M. Farooq, director of research at Chase Securities, said, “The relative calm on the political front, coupled with the finance minister’s rational interview on a media channel, alongside institutional and foreign buying this morning, has kept investors upbeat.”

However, he warned that participants were getting increasingly concerned about the record high interest rate “which could potentially lead to more defaults and non-performing loans (NPLs), particularly in the textile sector where higher energy costs compared to peers are making textile firms uncompetitive”.

Dear visitor, the comments section is undergoing an overhaul and will return soon.