Bulls dominated the trade floor at the Pakistan Stock Exchange (PSX) on Wednesday as shares gained over 800 points, reaching an all-time high.

The KSE-100 index gained 704 points, or 1.05 per cent, to stand at 67,590.26 at 12:01pm from the previous close 66,886.26 points. It closed at 67,756.03, up by 869.77 or 1.3pc, from the previous close.

On March 28, the benchmark KSE-100 touched a record high of 67,246.02 points in intraday trade, before settling at 67,142.12 — a record close. Today, it beat both those levels.

According to the PSX website, major gains were noted in sectors such as cement, transport, technology and communication and commercial banking.

A day earlier, the index had made modest gains which analysts had attributed to the 22-month lowest inflation reading below the Ministry of Finance’s projection of 23.5pc, which raised expectations for a reduction in the State Bank’s policy rate next month.

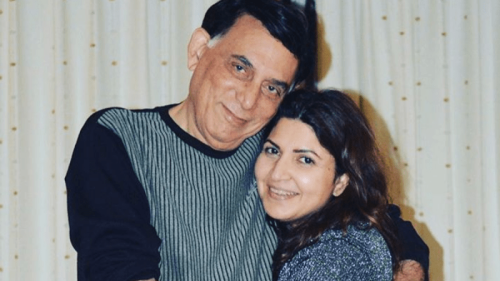

Speaking to Dawn.com today, Mohammed Sohail, chief executive of Topline Securities, said that market confidence was improving after “seeing good progress on the privatisation” of the Pakistan International Airlines (PIA), along with foreign portfolio investment in government papers.

“Cements stocks are in the limelight today amid expectations of a rate cut in the coming months.,” he said.

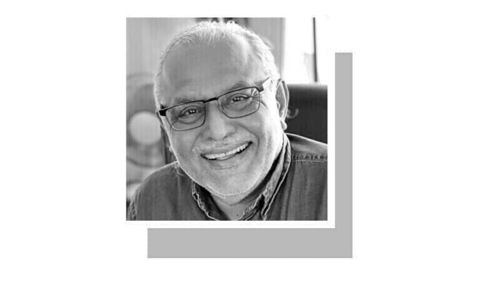

Faran Rizvi, head of equity sales at JS Global, said, “The decline in inflation figures signals economic resilience, leading investors to anticipate interest rate cuts of at least 150 basis points.”

However, he added that markets continued to trade “at very low multiples, particularly in the banking and oil and gas sectors, which are currently undervalued compared to historical norms”.

“We also identify trading opportunities in cement stocks. As interest rates decrease, the financial burden on these companies will diminish, and a natural uptick in demand will help maintain positive trading conditions for the sector’s stocks,” he said.

Yousuf M Farooq, director of research at Chase Securities, echoed the same sentiments. He attributed the gains to increased expectations of a rate cut after the drop in inflation.

“Moreover, cement sales numbers for the last month were better than market expectations and that has led to a rally in cyclicals,” he said.

Shahab Farooq, director of research at Next Capital Limited, said that upward trajectory was fueled by “foreign portfolio investment in Pakistan’s rupee-denominated government papers” which indicated confidence of foreign investors on the rupee-dollar parity, in addition to the overall outlook for the country as it heads for a longer and larger International Monetary Fund (IMF) programme.

Additionally, he noted that progress towards the restructuring and eventual privatisation of PIA helped propel market sentiments.

Dear visitor, the comments section is undergoing an overhaul and will return soon.