KARACHI: Amid growing prospects of realising Saudi investment in diversified sectors, the stock market on Monday turned in another record-breaking session in Ramazan, tossing the KSE 100-share index to an all-time high, closing above 69,500, though the volume fell day-on-day.

Ahsan Mehanti of Arif Habib Corporation told Dawn that Saudi Arabia’s commitment to fast-track the initial tranche of $5 billion investment in Pakistan boosted investor confidence, triggering a strong interest in blue-chip oil, banking, and pharma stocks as investors weigh deliberations over the $1 bn Saudi Reko Diq deal next month and Saudi oil-giant Aramco’s acquisition of stakes in Oil and Gas Development Company and Pakistan Petroleum Ltd.

Reports suggest this commitment was reached at a meeting between Saudi Crown Prince Muhammad bin Salman and Prime Minister Shehbaz Sharif in Makkah on Sunday night.

Mr Mehanti also noted that a surge in Brent crude prices above $90 per barrel, higher banking spreads and a high court case vacated against pharmaceuticals over the deregulation of non-essential medicines also contributed to a spectacular rally one day ahead of the long Eidul Fitr closure.

He, however, advised retail investors to remain cautious and focus on high dividend-paying stocks owing to the geopolitical crisis and government approvals to raise gas tariffs for captive power plants ahead of talks with the IMF for a new bailout.

He hoped easing political noise and speculations over IMF talks and climate change funds could send the PSX to new highs post-Eidul Fitr.

Arif Habib Ltd Head of Research Tahir Abbas said the market was upbeat as Finance Minister Muhammad Aurangzeb is planning to leave for Washington to attend IMF/World Bank spring meetings, where he was expected to negotiate a new Extended Fund Facility crucial for the long-term sustainability of the country.

“With inflation slowing down, investors are also anticipating an interest rate reversal soon, which is also boosting their confidence,” he added.

Topline Securities Ltd said the market started the shorter week (two trading sessions before Eid holidays) with a bang. Bulls resumed their northbound march as investors opted to further strengthen their equity positions by value hunting across the board, especially in blue-chip stocks.

Consequently, fertiliser, power, banks and tech contributed positively as Fauji Fertiliser Company, Hub Power Company Ltd, MCB Ban, Systems Ltd and Meezan Bank collectively added 486 points to the index performance.

Pak-Kuwait Investment Company Ltd Head of Research Samiullah Tariq thinks the bullish market is incorporating recent stability in forex reserves, overall confidence in the sovereign bond market, hopes of a new IMF deal, and expectations of the materialisation of a deal with the Saudi government.

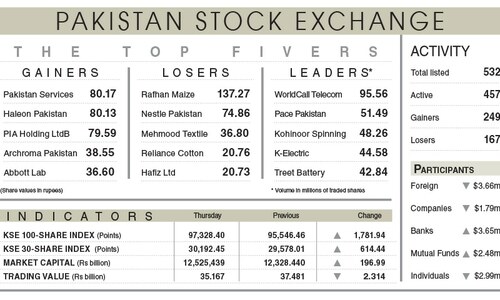

As a result the benchmark KSE 100-share index hit an intraday record high of 69,710.84, gaining 1,294.05 points. However, it closed at 69,616.84 points after adding 1,203.20 points, or 1.76 per cent from the preceding session.

The overall trading volume dipped 13.61pc to 335.61 million shares. The traded value fell by 14.35pc to Rs15.31bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan Telecommunication Company Ltd (33.75m shares), The Searle Company Ltd (21.10m shares), WorldCall Telecom Ltd (18.13m shares), K-Electric Ltd (17.48m shares) and Pakistan International Airlines Corporation Ltd (16.69m shares).

The companies registering the major increases in their share prices in absolute terms were Rafhan Maize Products Company Limited (Rs150.00), Mari Petroleum Ltd (Rs48.88), Shahmurad Sugar Mills Ltd (Rs41.93), Sazgar Engineering Company Ltd (Rs32.72) and Highnoon Laboratories Ltd (Rs26.04).

The shares registering the most significant decreases in their share prices in absolute terms were Hallmark Company Ltd (Rs49.93), Al-Abbas Sugar Mills Ltd (Rs35.00), Unilever Pakistan Foods Ltd (Rs22.00), Mehmood Textile Ltd (Rs10.00) and JDW Sugar Mills Ltd (Rs9.79).

Foreign investors remained net buyers as they bought shares worth $1.70m.

Published in Dawn, April 9th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.