KARACHI: After a long Eid break, the stock market extended its record-breaking spree to a fifth session on the prevailing bullish sentiments stemming from Saudi investment prospects, propelling the benchmark KSE 100 index to close at a new all-time high above 70,500 on Monday.

Ahsan Mehanti of Arif Habib Corporation attributed the market’s rally to speculations over the positive outcome of the visit by a Saudi delegation led by foreign minister to expedite the kingdom’s investment plans and bilateral trade.

He said Finance Minister Muhammad Aurangzeb’s departure for Washington for talks on a new Extended Fund Facility on the sidelines of the IMF and World Bank’s spring meetings fuelled a buying spree, especially by foreign investors, contributing to the PSX’s bullish close.

The market opened the session on a negative note, but a geopolitical restraint triggered massive value-hunting by investors, taking the market back into green territory and recovering early losses.

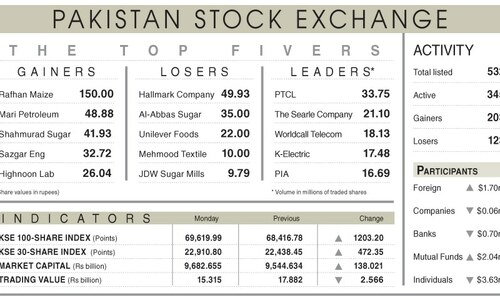

Topline Securities Ltd said Oil and Gas Development Company and Pakistan Petroleum Ltd rose 3.77pc and 1.48pc in the E&P sector amid growing expectations of progress on Saudi investment in the Reko Diq mining project during the delegation’s two-day visit.

Investors strategically reinforced their equity positions, engaging in value hunting, mainly targeting blue-chip stocks across the market. As a result, the E&P, power, and banking sectors made significant positive contributions, with Hub Power Company Ltd, OGDC, PPL and PSO collectively adding 325 points to the index.

On the flip side, MCB Bank, Systems Ltd and Engro Fertilisers Ltd saw profit-taking, wiping out 169 points.

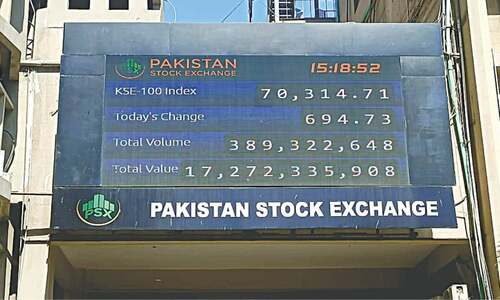

As a result of a mixed session, the benchmark KSE 100 index touched an intraday low of 69,914.11, losing 400.61 points, and a high of 70,608.88, gaining 294.17 points. However, it closed at 70,544.58 points after rising by 229.86 points, or 0.33pc from the preceding session.

The overall trading volume surged 42.58pc to 555.21 million shares. The traded value also increased by 27.27pc to Rs21.98bn on a day-on-day basis.

Published in Dawn, April 16th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.