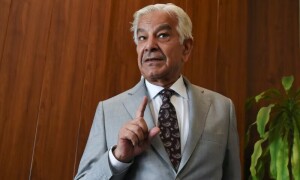

ISLAMABAD: As Prime Minister Shehbaz Sharif reaffirmed commitments to stringent tax enforcement, the Action to Counter Illicit Trade (ACT) Alliance has called for an immediate, comprehensive and across-the-board implementation of the track and trace system (TTS).

Despite the system’s introduction in 2019, promises of full implementation by December 2023 have faltered, revealing a critical lapse in fiscal management strategy.

According to a statement, the recent cabinet meeting chaired by PM Sharif underscored the dire state of tax evasion and illicit trade, with the Federal Board of Revenue (FBR) failing to effectively deploy TTS across vital industries.

“The underutilisation of TTS has left a significant portion of local manufacturers unchecked, leading to substantial losses,” it stated.

National Convener of the ACT Alliance Mubashir Akram has expressed concern over TTS’s selective and inadequate enforcement.

“Without equitable and transparent tax collection and enforcing TTS on all largescale manufacturers, the government will struggle to meet its financial targets,” he stated.

The ACT Alliance therefore urged the government and relevant departments to adopt a transparent and equitable approach to tax enforcement.

Published in Dawn, May 1st, 2024