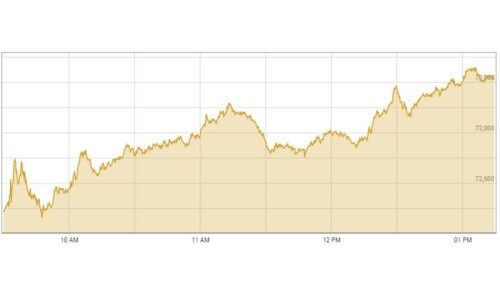

KARACHI: The robust growth in remittances and foreign exchange reserves, along with other stimulants, especially deceleration in short-term inflation, triggered bulls to stage a rally, sending the benchmark KSE 100 index to its highest-ever closing above 73,000.

Ahsan Mehanti of Arif Habib Corporation said the market rallied after the country reported a 27.99 per cent year-on-year increase in remittances from overseas Pakistanis to $2.81bn in April.

He said the cement sector outperformed the government’s target of a 27pc hike in the Public Sector Development Programme to Rs1.2 trillion for FY25. The rupee stability on surging State Bank of Pakistan’s foreign exchange reserves to $9.12bn for the week ending on May 3 after receipt of the final tranche of $1.1bn from the IMF under the SBA also contributed to a record close at PSX.

Topline Securities Ltd attributed this positivity to the Sensitive Price Index-based weekly inflation, which posted its fourth consecutive deceleration (down by 1.39pc week-on-week for the period ending May 9).

The cement and steel sectors remained in the limelight as they attracted buying interest, fuelled by the SPI numbers. This increased investors’ confidence in the decline in the State Bank of Pakistan’s policy rate going forward.

Lucky Cement, Dg Khan Cement, Pioneer Cement, Pakistan Oilfield Ltd, and Interloop Ltd made major positive contributions to the index, cumulatively contributing 218 points.

As a result, the benchmark index hit an intraday record high of 73,449.38 and a low of 72,876.84. However, the KSE 100 index closed at an all-time high of 73,085.50 points after rallying 427.45 points or 0.59pc on a day-on-day basis.

The overall trading volume rose slightly by 9.80pc to 741.19 million shares. The traded value also rose 5.05pc to Rs25.26bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (85.72m shares), Hum Network (51.46m shares), Pak Elektron Ltd (33.64m shares), Fauji Cement Company (29.77m shares) and Hascol Petroleum (26.58m shares).

The shares registering the most significant increases in their share prices in absolute terms were Hoechst Pak Ltd (Rs94.71), Bhanero Textile (Rs74.75), Lucky Core Industries (Rs59.69), Highnoon Lab (Rs31.09) and Pak Services (Rs30.03).

Foreign investors remained net sellers as they offloaded shares worth $0.30m.

Published in Dawn, May 11th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.