KARACHI: The stock market continued its decline on Wednesday as investors took profits due to anticipated harsh budgetary measures, causing the KSE 100 share index to close the session below 75,000.

Ashan Mehanti of Arif Habib Corporation said the market witnessed across-the-board selling pressure amid mounting fears about likely tough taxation proposals in the federal budget 2024-25, to be unveiled on June 7. The government would have to comply with the International Monetary Fund’s directions to secure a new bailout package to meet its external repayment obligations.

He, however, added that political noise, subdued growth, weak foreign direct investment numbers and reports of unresolved power sector circular debt reaching Rs5.3 trillion also contributed to the bearish close at PSX.

Topline Securities Ltd noted that the E&P, banking and fertiliser sectors all contributed to the negative trend, with Oil and Gas Development Company, Pakistan Petroleum Ltd, Bank Al-Habib Ltd, Fauji Fertiliser and Engro Corporation cumulatively lost 323 points. However, Service Industries Ltd, Lucky Core Industry and Faysal Bank Ltd attracted buying interest, adding 65 points to the index.

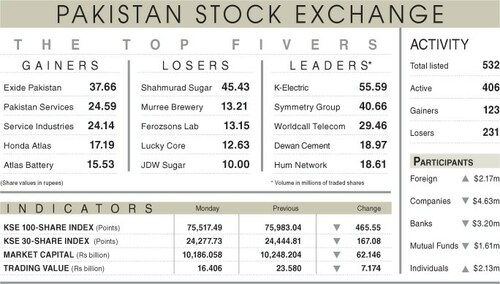

As a result, the benchmark index hit an intraday high of 75,667.31 and a low of 74,760.10. However, the KSE 100 index settled at 74,836.30 points after losing 681.19 points or 1.90pc on a day-on-day basis.

However, the overall trading volume dipped 8.51pc to 408.07 million shares. However, the traded value inched up 0.57pc to Rs16.50bn day-on-day.

Stocks contributing significantly to the traded volume included K-Electric Ltd (38.64m shares), WorldCall Telecom Ltd (22.38m shares), Dewan Farooque Motors (19.35m shares), Dewan Cement (15.92m shares) and Faysal Bank Ltd (14.49m shares).

The shares registering the most significant increases in their share prices in absolute terms were PIA Holding Co (Rs60.83), Service Industries (Rs43.83), Lucky Core Industries (Rs43.00), Pakistan Services (Rs27.36) and Sapphire Fibres (Rs16.08).

The companies registering the major decreases in their share prices in absolute terms were Hoechst Pakistan (Rs113.80), Hallmark Company Ltd (Rs45.27), Shahmurad Sugar Mills (Rs41.79), Nestle Pakistan (Rs40.18) and Rafhan Maize Products Company Ltd (Rs38.03).

Amidst the market fluctuations, foreign investors remained steadfast, demonstrating their confidence in the market. They continued to be net buyers, picking shares worth $1.85m.

Published in Dawn, May 30th, 2024