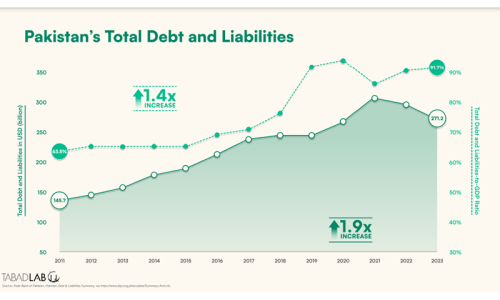

PAKISTAN’S debt stock has grown exponentially in recent years. So have debt payments, putting pressure on the budget. With the government running an unsustainably high fiscal deficit that averaged 7.3pc of the economic output in the past five years, it is not surprising that the national debt has already surged to Rs78.9tr — including a domestic debt of Rs43.4tr and external loans of Rs32.9tr.

The country is in a debt trap where it must borrow more to pay back its existing debt — domestic and external loans both. It is thus only natural for annual debt payments to also spike. For example, the authorities had anticipated debt servicing to jump to Rs7.3tr or almost 58pc of the budgeted expenditure for the ongoing fiscal. However, according to a report, they have now revised these estimates to Rs8.3tr.

The finance ministry’s Mid-Year Budget Review Report for the outgoing year confirms these concerns. The report shows that the nation’s debt payments spiralled by more than 64pc to Rs4.2tr during the first six months to December, an increase attributable not only to the mounting stock of debt accumulated to finance the fiscal deficit but also to the surge in the cost of domestic debt because of a record-high interest rate of 22pc. The report says the expenditure on debt servicing during the six-month period far outpaced tax revenue growth, bringing “spending on development to zilch”.

In the report, the ministry has blamed elevated domestic interest rates for our growing debt servicing woes. With the government covering nearly 80pc of its fiscal deficit through commercial bank loans amid drying official foreign flows, the interest rates are of primary concern as domestic debt payments accounted for nearly 90pc of the total debt servicing costs during the first half of the fiscal. The cost of borrowing has proved to be a major shock for the entire economy, and not just for the government, as new private investment has come to a halt and growth has stagnated.

What the report doesn’t discuss are the reasons behind this debt trap. While the higher interest rates are a burden, the main challenge is the government’s failure to control its fiscal deficit that is forcing it to accumulate more debt every day. Indeed, a reduction in interest rates will provide relief but will not solve the issue of burgeoning deficit and debt accumulation.

The task before the government is to boost its tax-to-GDP ratio to the global average by taxing the economy’s untaxed and undertaxed sectors, as well as eliminating wasteful expenditure to cut the fiscal deficit to sustainable levels to minimise its borrowing requirements for financing the budget. Do the authorities realise this and are they moving in this direction? We will know once the budget is announced next month.

Published in Dawn, May 30th, 2024