BEIJING: The National Bank of Pakistan (NBP) and China-Pakistan International Silk Road Industry Investment Management Company Ltd have signed an MoU to facilitate investment in key projects, promote industrial cooperation, support the establishment of special economic zones (SEZs) and boost bilateral trade.

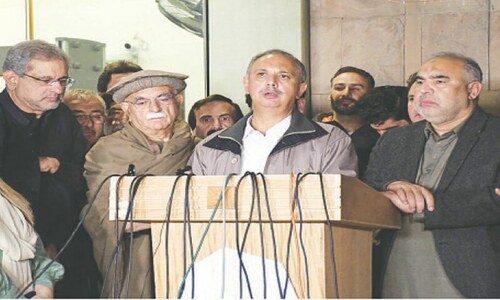

Economic Minister Aslam Chaudhary, Liu Jiang Hua from China-Pakistan International Silk Road Industry Investment Management Company Limited, representatives from Dan Zhou Government, Hai Nan Province, Zhang Yu Bo, MCC & Bank of Tianjin witnessed the signing ceremony held at Pakistan Embassy on Saturday.

The event was joined virtually by Riaz Hussain, SEVP and Group Chief, International, Financial Institutions and Remittances Group and Hasan Jamal, SVP, Investment Banking Group National Bank of Pakistan, Head Office, Karachi.

Mr Chaudhary briefed the participants on the government incentives offered to attract foreign investment, especially from China.

He said SEZs are being established across Pakistan where Chinese enterprises could relocate their industry and export products to different countries, taking advantage of preferential agreements signed by Pakistan with various countries.

The minister said that Pakistan, with a population of over 225 million, is itself a big market, and Chinese companies could benefit from it.

He said the government is focusing on industrialisation in the second phase of the China-Pakistan Economic Corridor (CPEC) and offering opportunities in various sectors.

He invited Chinese entrepreneurs to come to Pakistan and take advantage of facilities and incentives for setting up their industrial units.

Aslam Chaudhary opined that the MoU would help the Chinese companies invest in different projects and promote industrial cooperation between the two countries.

Sheikh Muhammad Shariq told the audience that NBP is the largest and state-owned bank and amongst the domestic systematic important bank from Pakistan, operating with 18 overseas branches located in South Asia, Central Asia, Middle East, Western Europe and North America.

He said that NBP is amongst the major lender to the projects under CPEC and handling large portion of bilateral trade between China and Pakistan.

“We also maintain the largest portfolio of corporate and investment banking in Pakistan, he added.

Mr Shariq said that the MoU represents a commitment to fostering stronger ties, enhancing financial cooperation, and exploring new opportunities for growth and innovation.

This would also help that NBP will open an operational branch in China to further facilitate bilateral trade. Through this partnership, the bank aims to leverage its collective expertise and resources to develop cutting-edge financial solutions, support sustainable economic development, and better serve the two communities, he added.

Published in Dawn, June 2nd, 2024