KARACHI: Despite growing voices from almost all sectors of the economy over the proposed budgetary taxation measures for 2024-25, the stock market extended its record-setting spree to the third consecutive session after the Eid holidays on Thursday, propelling the benchmark KSE 100 index to an all-time high above 78,000.

Media reports suggest that, except for the capital market, representative chambers of almost all other sectors of the economy are protesting and urging the government to review its ambitious plans to improve the tax-to-GDP ratio by projecting an abnormally huge revenue collection target burdening the industry with imposing new taxes and withdrawing exexmptions even when the Federal Board of Revenue is set to miss the current year’s downward revised target.

However, explaining reasons for this robust equity market performance, AKD Securities Ltd Chief Executive Officer Muhammad Farid Alam told Dawn that the index surged because there were no significant changes to the capital gains tax for equity investors as was in the news. The budgetary measures were aligned with the International Monetary Fund guidelines, which have increased the likelihood of securing a new IMF loan.

Additionally, he added that the positive comments from credit rating agencies regarding Pakistan’s contractionary budget and the lack of additional aggressive taxation on heavy-weight banks contributed to the index’s strong performance.

“Slower economic growth is expected to stabilise the rupee and reduce imported inflation, thereby enhancing the outlook for further monetary easing,” he observed.

Mr Farid believes the normalisation of the taxation regime for exporters would impact their expansion plans, and he expects the tax rates to be rationalised before the budget approval.

Also, a Rs200 billion subsidy package on electricity bills for industries would help partially offset the effects of fiscal contractionary measures on growth. The market is still cheap on various variables which equity investors see locally and internationally.

Topline Securities Ltd CEO Mohammed Sohail told Dawn that for the stock market, higher taxes mean a lower deficit for the country. “And this is what is required to stabilise the economy.”

He said the market reached another record high as positive sentiments continued amid hope that the new budget would help secure a long-term IMF deal. “Fitch and Moody’s have also hinted that due to aggressive taxation measures, Pakistan may be able to secure new funding. Besides this, the government’s plan to reduce power tariffs for industries also boosted sentiments, as this will reduce costs and support corporate profits.

However, some industry leaders think the discounted industrial power tariff, announced by the prime minister post-budget, has already been nullified with a fresh increase in base tariff and imposition of taxes on the export sector, mobile manufacturing, EVs, etc., and is still very costly gas prices.

Mr Sohail said with FTSE rebalancing, there are chances of further foreign buying as the PSX, for the first time after 15 years, has provided a gain of 100pc to equity investors in less than a year.

Foreign investors turned net sellers as they offloaded shares worth $2.00m.

Ahsan Mehanti of Arif Habib Corporation said projections for the IMF deal, thin inflation, external account stability, and fiscal discipline outweigh economic challenges to exports, surging power tariffs, and tough tax measures for FY25.

Pak-Kuwait Investment Company Head of Research Samiullah Tariq attributed the bullish spell to a significant inflow from retail investors, as alternative avenues like real estate have been heavily taxed in the budget.

As a result, the benchmark index hit an intraday record at 78,890.37 points and a low of 76,896.82. However, the index settled at an all-time high at 78,801.53 after staging the fourth-largest single-day rally of 2,094.76 points or 2.73pc on a day-on-day basis.

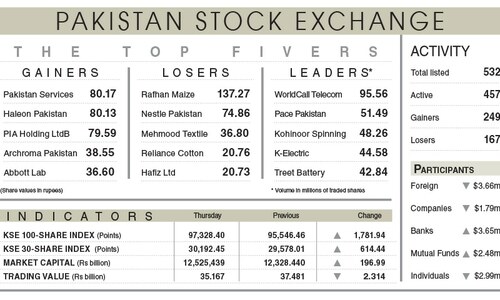

The overall trading volume rose 14.33pc to 452.63 million shares. However, the traded value dipped by 3.23pc to Rs20.67bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Silkbank Ltd (53.58m shares), K-Electric Ltd (23.10m shares), Habib Bank (20.94m shares), The Bank of Punjab (20.65m shares) and WorldCall Telecom (19.48m shares).

The shares registering the most significant increases in their share prices in absolute terms were Rafhan Maize (Rs86.62), Ismail Industries (Rs63.93), Colgate-Palmolive (Rs49.01), Exide Pakistan (Rs47.32) and Mehmood Textile (Rs41.56).

The companies registering significant decreases in their share prices in absolute terms were Bhanero Textile (Rs75.99), Faisal Spinning (Rs17.00), Philip Morris (Rs9.77), Unilever Foods (Rs9.68) and Siemens Pakistan Engineering (Rs8.55).

Published in Dawn, June 21st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.