Setting aside their worries, Pakistanis engaged in qurbani (sacrifice) and Eid festivities this year as best as they could. However, market sources confirm that the level of activity was noticeably affected by the sluggish economic situation.

Despite the rush at parks and picnic spots, Eidul Azha was relatively quiet this year. This occurred despite the generous inflow of funds from expatriates, who typically reaffirm familial bonds during the holy festival by supporting needy relatives and fulfilling their sacrificial obligations back home.

Pakistan received a record of $3.2 billion in remittances in May, the month preceding Eid. Currency dealers expect June inflows to surpass this mark. In addition to the attractive and broadly stable exchange rate, the surge in remittances is attributed to religious motivations at this time of the year, particularly supporting Haj and Eidul Azha festivities. Many overseas Pakistanis cover Hajj expenses for their parents and have their relatives perform qurbani on their behalf.

Malik Muhammad Bostan, President of the Forex Association of Pakistan, believes a notable portion of the increased remittances during this period feeds into the Eid economy. “Approximately five to 10 per cent of the money received by families from overseas flows into Bakra Piris and shopping malls around this time each year.

Unable to secure their asking prices, cattle dealers and farmers sold their stock at whatever price they could fetch, opting to return home with some dividends instead of empty-handed

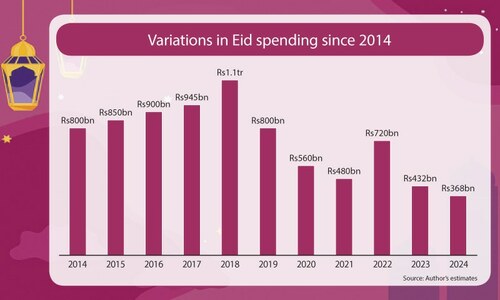

“While the wealthy are always ready to spend, it’s the middle class, due to their sheer numbers, that truly drives the market. The economic distress within this class has visibly shrunk the Eid market this year,” he remarked.

In response to a query, Syed Akhtar Shahid, President of All Hyderi Trades Working Committee, a trade body in the upper-middle-class locality in Karachi, said, “The market situation this year was even worse than last year, which was already slower than usual.

“Although the actual sales numbers are still being consolidated, it seems retailers of Eid-related items only reached about 25pc of our expectations. Many people who performed qurbani till last year couldn’t keep up with the inflation and had to forego it this year; when covering for basic needs becomes challenging, adjustments have to be made,” he remarked.

Cattle traders reported a price crash in several mundis (markets) across Pakistan. “There was a significant gap between the asking prices and what common visitors were willing to pay in the days leading up to Eid. Sensing the situation, suppliers lowered their prices, resulting in more moderate deal prices. After accounting for inflation, the real price increase was marginal,” noted Rahim Sumar, a cattle broker, defending the average 30pc increase in cattle prices.

Estimates vary depending on the source, but all agree on the limited footfall in both regular and cattle markets. “Window shoppers dominated the crowds in cattle mundis and consumer markets. The long holidays provided extra time but not the funds to freely celebrate the festival in style. People had to cut corners, limiting Eid shopping to just the children and switching to more affordable joint qurbani options,” noted a market observer.

Mindful of last year’s experience and of the economic pressure on average urban families, cattle dealers and farmers adopted a more cautious approach this year. Many, unable to secure their asking prices, sold their stock at whatever price they could fetch, opting to return home with some dividends from the hard work involved in raising livestock.

“Instead of blindly heading to cities with truckloads of livestock, this year farmers displayed greater maturity and calculated risks more realistically,” commented a cattle market operator. “Despite an increase in the number of animals in the country over the past year, the supply of sacrificial animals remained subdued. The harsh summer and its potential impact on animal health likely also discouraged oversupply,” he added.

According to the current Pakistan Economic Survey (PES), the livestock sector accounted for approximately 61pc of the agriculture value added and 15pc of the GDP during FY24, with a growth rate of 3.8pc. “The gross value addition of the livestock sector has shown an increase, rising to Rs5.8 trillion in 2023-24 from Rs5.59tr in 2022-23, marking a growth rate of 3.9pc,” states the PES.

Sources in the leather industry, observing emerging trends, noted the continued prevalence of joint qurbani due to economic pressures, with no significant expansion in the Eidul Azha market. However, initial estimates from the Pakistan Tanners Association (PTA) indicated a higher collection of hides in 2024 compared to 2023. In the main categories, cow hides increased by about 0.26 million to a total of 2.86m, and goat hides increased by about 0.3m to a total of 3.3m.

Defending his assertion of market shrinkage, an observer doubted the data provided by the PTA, terming it indicative at best, noting that a reliable, regulated system for registering, monitoring, and collecting hides and skins has yet to develop in the country. “Their estimates are creative exercises with no accountability,” he lamented. The dominance of cash-based transactions in the cattle trade further complicates the collection and monitoring of data.

A tiny minority, primarily those who prefer institutions to handle their qurbani obligations or expatriates managing qurbani from afar, use digital platforms and banking channels for their transactions. These methods are easier to trace and track, according to market insiders.

During Eidul Azha, there is generally a net transfer of capital from urban to rural sectors. While it is challenging to pinpoint the exact distribution of windfall gains among over 8m families engaged in animal husbandry, it is reasonable to assume that benefits trickle down, even reaching those at the lowest rungs of the rural social order in some form.

Published in Dawn, The Business and Finance Weekly, June 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.