• All 1,197 cut-motions moved by opposition rejected

• MQM-P, JI stage walkout, SIC lawmakers stay in house

• Murad defends bringing certain professionals under tax net to increase revenue generation

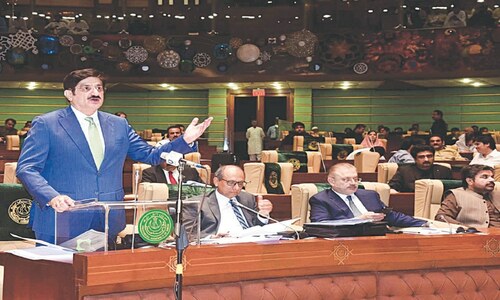

KARACHI: The Sindh Assembly on Friday passed the Rs3.056 trillion provincial budget 2024-25 with majority vote, rejecting all cut-motions moved by the opposition members belonging to the Muttahida Qaumi Movement-Pakistan and Jamaat-i-Islami.

Amid protest and subsequent walkout by the MQM-P and JI members, the house also passed the Sindh Finance Bill of estimated Rs76 billion taxes and levies.

As Chief Minister Murad Ali Shah presented the Sindh Finance Bill in the house, Leader of the Opposition in the Sindh Assembly Ali Khurshidi rose to request Speaker Syed Awais Shah to form a committee for deliberations on the bill and consideration of opposition members’ proposals / amendments.

The opposition members had moved 1,197 cut-motions — a refusal against a specific allocations and demands in the budget proposal, terming them unnecessary and burden on the public exchequer — seeking reductions in the allocations to Chief Minister Secretariat.

However, all of them were opposed by the chief minister, who had laid the budget 2024-25 before the assembly.

After the rejection of some cut-motions, the opposition members’ all cut-motions were clubbed with their consent and subsequently rejected en bloc with a majority vote.

The provincial budget for the next financial year totals Rs3.056tr, with over Rs900bn allocated for development projects.

It includes Rs1.96tr in current revenue, Rs184bn in current capital, Rs42bn for debt repayment, and Rs142.5bn for government investments.

The chief minister submitted to the chair that under the rules Finance Bill could not be referred to the committee.

He pointed out that the opposition had ample time to forward its proposals / recommendations as the budget was presented in the assembly two weeks ago.

The MQM-P lawmakers chanted slogans against the tabling of the finance bill and tore its copies before they walked out of the house. Lawmakers belonging to Pakistan Tehreek-i-Insaf-backed Sunni Ittehad Council, however, stayed in the house.

Giving a brief introduction of the Finance Bill, the chief minister said that it was expedient to enact a law to rationalised, levy and enhance certain taxes and duties and to amend certain laws in the province.

He said that it was needed to bring certain professionals under the tax net as the provincial government wanted to increase its revenue generation. “If revenue is not enhanced, how can government provide services to people,” he questioned.

Duties, taxes on air tickets, cars, professionals

Under the newly passed Sindh Finance Act, stamps duty has been increased in certain categories.

Besides, Rs1,000 tax has been imposed on the sale or transfer of a registered vehicle and sale or transfer of immovable property or re-conveyance of a mortgage property.

There will be a tax of Rs5,000 on the booking of an apartment, shop, house, office or plot for the sale of general public in a project approved by the Sindh Building Control Authority.

A tax of Rs50 would be charged on air tickets for domestic flights and Rs400 for international flights.

Under the Sindh Finance Act, the excise duty on imported cars and jeeps with engine capacity of 3,000cc would be Rs450,000; Rs275,000 on 2,000cc to 2,999cc; Rs100,000 on 1,500cc to 1,900cc imported motor cars and jeeps and Rs50,000 on locally manufactured or assembled vehicles with engine capacity of 2,000cc and above.

Besides, the assembly with majority votes also approved 158 demands for grants for the financial year 2024-25 moved by the chief minister, who also holds the portfolio of finance.

Later, the assembly session was prorogued.

Published in Dawn, June 29th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.