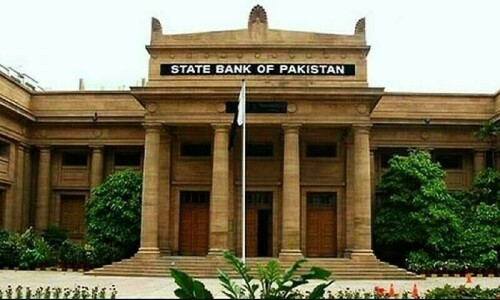

KARACHI: The country witnessed the highest-ever outflow of profit and dividends by foreign investors in FY24 since FY18 as the State Bank of Pakistan (SBP) had to clear the backlog under pressure from the International Monetary Fund, China and others.

Profits and dividends outflows recorded an almost seven times increase to $2.215 billion in FY24 from just $331 million in the preceding fiscal year. This clearly reflects Pakistan’s policy of not allowing dollar outflows. In FY23, the country had a serious problem with foreign exchange reserves and was about to default at the end of FY23. The IMF rescued it through a $3bn Standby Arrangement.

However, banking sources said the SBP gradually eased the outflows, finally clearing about $2.2bn in FY24. They said profits are still stuck up. About $1.8bn of Chinese investors’ profits were held back in the outgoing fiscal year.

The State Bank’s data showed that the highest profit of $638.6m was released for financial businesses (banks, insurance) in FY24 against just $36.2m in FY23. Banks made huge profits in FY24. Investors from the Middle East are the biggest stakeholders in Pakistan’s banking sector. The outflows show that their earnings are much bigger than those of any other sector.

SBP clears backlog on IMF, China pressure

The profits outflow for the power sector was $245.8m in FY24, compared to $44m in FY23. Similarly, outflows for telecommunications were $202.8m ($13.2m in FY23); transport $174m ($6m in FY23); food $154m (0.7m in FY23); and petroleum refining $131m (0.5m in FY23).

The ease in profit outflow increased the confidence of foreign investors, and foreign direct investment improved by 17pc to $1.9bn in FY24.

Debt repayments

After announcing the monetary policy, the SBP governor held a briefing session with researchers and analysts.

According to Arif Habib Ltd, the total external debt repayments are projected to be $26.2bn in FY25, comprising $22bn in principal and $4bn in interest.

Of this, $16bn, including $4bn in bilateral commercial loans, is expected to be rolled over. This leaves a net repayable amount of $10bn, of which $1.1bn was paid this month. The remaining net repayable amount over the coming months is $9bn.

The SBP foreign exchange reserves are expected to reach $13bn by the end of FY25, up from the $9.1bn.

The SBP governor said all pending profit and dividend payments had been made. “No payment is pending with the banks, provided the documentation is complete,” he said

Regarding debt sustainability, the SBP governor noted that Pakistan’s external position has improved.

“Most short-term debt, especially $8bn in commercial loans, has been repaid and substituted with long-term multilateral loans. Therefore, there should be no concern about debt sustainability at present.

Published in Dawn, July 30th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.