KARACHI: Despite a sharp deceleration in inflation, the small cut in interest rate drew a dull reaction from equity investors on Wednesday. The stock market came under selling pressure and finished the session negatively amid a lack of fresh triggers.

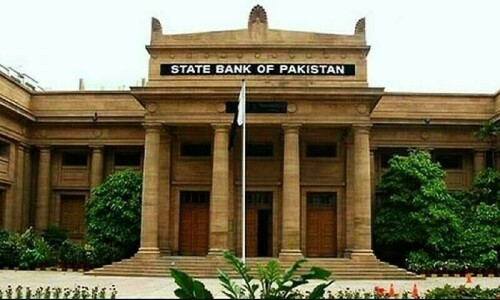

Ahsan Mehanti of Arif Habib Corporation said stocks closed under pressure after the State Bank of Pakistan delivered a meagre 100 basis point cut in its policy rate to 19.5pc to ease inflationary pressures. The bank projected subdued economic growth at 2.5pc-3.5pc in FY25 and reported record repatriation of $2.2bn by foreign investors in FY24.

He said the weak rupee and uncertainty over the terms of re-profiling China’s energy debt played a catalyst role in the bearish close.

Topline Securities Ltd said Fauji Fertiliser Company announced its 2Q2024 result, posting earnings per share of Rs12.22 and a cash dividend of Rs10 per share, higher than industry expectations.

During the day, Fauji Fertiliser, Hub Power, Millat Tractor, Engro Corporation and Bank Al-Habib cumulatively added 269 points to the index. Conversely, Engro Fertiliser, Dawood Hercules and Habib Bank saw some profit-taking as they lost 158 points.

As a result, the benchmark index hit an intraday high of 79,327.05 points and a low of 78,518.23. However, the index settled at 78,628.81 after losing 198.94 points or 0.25 per cent on a day-on-day basis.

The overall trading volume fell 15.63pc to 313.08 million shares. The traded value also dipped 8.04pc to Rs17.61bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included The Organic Meat (24.83m shares), The Searle Company (24.06m shares0, Fauji Cement (15.81m shares), Fauji Fertiliser (15.59m shares) and Waves Home Appliances (13.35m shares).

The shares registering the most significant increases in their share prices in absolute terms were Rafhan Maize (Rs77.44), Pak Services (Rs38.57), Mehmood Textile (Rs38.24), Khyber Textile (Rs30.78) and Unilever Foods (Rs22.18).

The companies registering significant decreases in their share prices in absolute terms were Nestle Pakistan (Rs97.13), Pak Engineering (Rs56.40),

Bata Pakistan (Rs35.80), Sazgar Engineering (Rs35.68) and Exide Pakistan (Rs23.92).

Foreign investors remained net sellers as they sold shares worth $0.10m.

Published in Dawn, July 31st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.